Editors’ picks for 2023: ‘When is a corvette not a corvette?’

Originally published on 26 May 2023.

The defence strategic review highlighted the need for the Royal Australian Navy to have two levels of surface combatants to provide ‘increased strike, air defence, presence operations and anti-submarine warfare’. While the DSR doesn’t directly recommend changes to the structure of the surface combatant fleet, it says: ‘Enhancing Navy’s capability in long-range strike (maritime and land), air defence and anti-submarine warfare requires the acquisition of a contemporary optimal mix of Tier 1 and Tier 2 surface combatants, consistent with a strategy of a larger number of smaller surface vessels.’

The requirement for more smaller vessels, combined with the need for strike and anti-submarine warfare, has fuelled public discussion on whether the RAN requires corvettes to deliver the range of effects the DSR describes. The discussion has intensified following the release of the Australian National Audit Office report on the Hunter-class frigate program, which confirms that the cost of the nine vessels has already increased by 50%, years before the first is to be delivered.

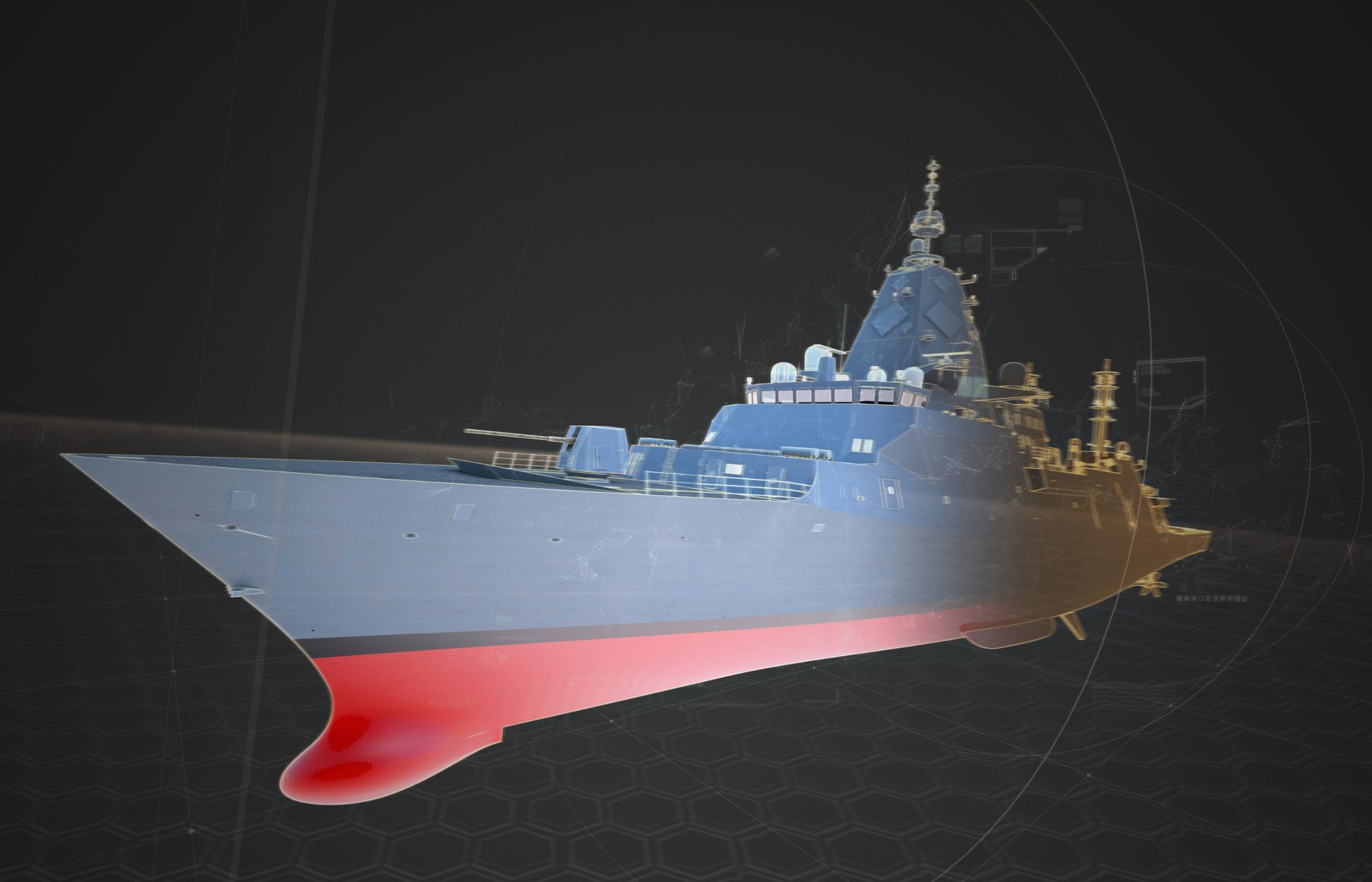

In late 2022 there were reports of offers to the RAN of corvettes from TKMS and Navantia, which are delivering such vessels to Saudi Arabia, and Luerssen, which is overseeing the construction of offshore patrol vessels (OPVs) for the RAN and has delivered K130 corvettes to the German navy.

In considering corvettes for the RAN, it’s fair to ask what a corvette is, and what the navy needs them for. A corvette is not as simple as it would first appear. Although naval history buffs will likely baulk at the comment, there’s no strict definition of a corvette—and the RAN has a history of not sticking to strict definitions of types of ships.

The hierarchy of ship types is generally determined by the size, weight, firepower and employment of each vessel. One might accordingly define the hierarchy from smallest to largest, with associated growth in firepower from a patrol boat to a corvette, then a frigate, then a destroyer, then a cruiser, and so on.

The RAN’s fleet structure demonstrates that this hierarchy isn’t strict. The 10,000-tonne Hunter-class frigate is to be almost three times the displacement of the Anzac-class frigate at 3,600 tonnes. On the other hand, the RAN’s Hobart-class destroyers are based on the design of the Spanish F-100 frigate and have a displacement of about 7,000 tonnes, which makes them more akin to a traditional frigate. A modern corvette can range anywhere between 500 tonnes and 3,000 tonnes, almost the size of an Anzac-class frigate. You can see the conundrum.

Picking the term ‘corvette’ and attaching it to a particular naval task doesn’t help.

Any discussion about the RAN’s force structure must focus on the effects it needs to deliver, balanced against its key constraints.

The DSR recommends: ‘Australia’s immediate region encompassing the northeastern Indian Ocean through maritime Southeast Asia into the Pacific, including our northern approaches, should be the primary area of military interest for Australia’s National Defence.’

This highlights what the RAN has known for some time, that force generation no longer relies on producing one major surface combatant to deploy on a unique operation in a far-off place. The RAN fleet requires flexibility and persistence. Australia has the world’s third largest economic exclusion zone and achieving flexibility and persistence requires scale—a surface combatant fleet much greater than the 11 vessels now in service, or the 12 planned for the future fleet.

In heralding the ‘missile age’ in modern warfare (although decades late), the DSR by implication also highlights that the littoral zones of Australia’s immediate region will likely be a contested environment. By implication, not only does the RAN need flexibility and persistence at scale, it also requires its platforms to have a minimum degree of air-defence capability. This puts the Arafura-class OPV in the firing line both literally and figuratively, noting its extremely limited armament.

In addition to flexibility, persistence, scale and self-defence capability, the RAN also has challenges in the number of missiles it can put to sea from an offensive-capability perspective. This has been explored in the ASPI publication The Hunter frigate: an assessment and won’t be revisited here, except to say that it will need to be a key consideration of the fleet mix. The RAN must be able to get more missiles to sea than it can now. This uncomfortable fact has led to calls for more Hobart-class destroyers to be produced, and offers from Navantia to do so. While the acquisition of further destroyers, or ‘Tier 1’ capabilities, is not the subject of this article, it must be acknowledged that the ability to put missiles to sea in as many platforms as possible must be a key consideration for the RAN.

Given the distances the RAN will be required to project across, a key ingredient of persistence and presence is speed. Another limitation of the Arafura OPVs is their maximum speed of 20 knots, slow for a modern naval vessel. The transition to a ‘focused force’ in light of the DSR must not lose sight of the reality that Australia’s maritime strategy still requires the RAN to deliver a constabulary function while the Australian Border Force fleet remains constrained. The rightful focus on warfighting capability for the RAN must not ignore the fact that, under the current construct, the RAN’s smaller vessels, be they patrol boats, OPVs or corvettes, will be required to undertake constabulary roles. The RAN couldn’t trade this role away without it having to be resourced elsewhere.

While this all points to solutions requiring several new platforms, the RAN’s key constraints of workforce and strategic warning time must be taken into account. The DSR reinforces the finding in the 2020 defence strategic update that Australia can no longer rely on having 10 years’ warning of a major conflict. That means the fleet to support the DSR’s requirements—noting the limitations of the current fleet—must be acquired quickly to be strategically relevant. So, is it possible to modify the Arafuras to meet the capability the RAN requires, or should a new platform of a developed design be acquired quickly through some form of commercial off-the-shelf agreement?

The DSR acknowledges that the RAN faces significant workforce constraints. Increasing the number of surface combatants will require a large increase in the number of personnel to crew them. That will come on top of the need to expand the submarine workforce to crew the nuclear-powered submarines coming under the AUKUS agreement. Each US Virginia-class boat will require three times more personnel than the RAN’s Collins-class boats. Consequently, the RAN is unlikely to be able to support significant growth in the requirements to crew surface combatants. Transitioning some of the roles assigned to the RAN’s fleet to uncrewed capabilities may be a future option, but it’s unlikely to resolve some of the key challenges faced by the RAN fleet in the near term.

All this demonstrates that rather than focusing on a specific type or class of ship with dubious definitions such as a corvette, we should focus on the effects that need to be delivered. Flexibility, persistence, scale, self-defence, offensive-strike capabilities and constabulary operations must be weighed against the clear constraints, delivery timeframes and workforce constraints. Consideration of these elements will lead to some clear conclusions about what is in the art of the possible for the future fleet mix.