Nothing Found

Sorry, no posts matched your criteria

Sorry, no posts matched your criteria

One of the proudest boasts of the Coalition government is that it takes national security seriously, and it does. Over the next 10 years, Australia will spend $200 billion on defence in the nation’s largest ever peacetime rearmament program. As the federal election looms, it is fair to ask why we are doing it and what are we getting for it.

In simple terms, we are rearming because the strategic environment has changed dramatically, especially in the maritime domain. Almost half of that $200 billion is earmarked for the navy, $90 billion of which will go to building 56 warships in Australia. Unfortunately, the build won’t be complete until the mid-2050s.

Geography means that Australia’s livelihood is tied to the sea, with our security and prosperity dependent on access to the Pacific and Indian Oceans. Our exports must travel by ship to reach their destinations, and we rely on the sea lanes to import liquid fuel and other vital goods.

Australians tend to pay little attention to this simple fact because we have seldom had reason to. We have always allied with ‘great and powerful friends’ that could be counted on to keep our sea lanes open. Initially, the Royal Navy was Australia’s guarantor. Then the US Navy took its place—and in the 75 years since World War II, it hasn’t faced a peer competitor. But the strategic environment has changed. The US Navy, by its own admission, is not the globally dominant force we have long assumed it to be.

Both warship numbers and capabilities are important, especially if you accept global responsibilities. In 1989, the US Navy had 594 combat ships. Now it has 275. The US plans to rebuild to 355 ships, but admits that this can’t be achieved within 30 years and that the overall cost will be a third higher than that of today’s navy. And recent US defence budget increases are unlikely to last.

The US considers that the West is being challenged by four nations: China, Russia, Iran and North Korea. Both Australia and the US describe our regional geostrategic environment as the Indo-Pacific. Three of those four challengers are in our region. If things go bad, this has major implications for our region, our prosperity and our security.

The biggest challenge for our region and the world is the emergence of China as a great power.

China’s military is being restructured into one with a greater balance between its land, sea, air and rocket components, and we all know how good China’s cyber forces are.

A major part of the restructure is the priority given to the People’s Liberation Army Navy. Recently, Chinese President Xi Jinping declared that ‘the task of building a powerful navy has never been as urgent as it is today’ and urged the PLAN to ‘prepare for war’. Chinese military leaders talk often and openly about the PLAN’s ambition ‘to gain an ability like the US Navy so that it can conduct different operations globally’, and about how to defeat the US in the Pacific by sinking its aircraft carriers. China is investing massive resources into the PLAN, which is growing rapidly in its size and sophistication.

Analysis from the Center for Strategic and International Studies shows that the PLAN already has more deployable vessels than the US Navy. In the past five years, China launched more new vessels than the entire Royal Navy has. It was able to do that through large-scale investment in dual-use shipbuilding facilities as the world’s largest commercial shipbuilder.

China is also developing larger, more advanced vessels capable of longer-range operations. China’s second—and its first domestically built—aircraft carrier will enter service soon. It’s been suggested that the PLAN could eventually field up to six increasingly sophisticated carriers. China is also commissioning new amphibious assault ships capable of transporting marines and helicopters. A new line of cruisers, similar to the US Navy’s Ticonderoga-class Aegis-equipped cruisers, is being launched, as are new models of destroyers, frigates, corvettes and submarines. These are all ‘comparable in many respects to most modern Western warships’. We are witnessing the birth of a Chinese ‘blue water’ navy that will be able to conduct operations far from China’s coastline.

This is not about the South China Sea or other territorial waters claimed by the PRC. It is driven by a desire to project power on a global scale.

While he acknowledges that war is not inevitable, Graham Allison cautions that ‘war between the US and China in the decades ahead is not just possible but much more likely than currently recognized’, and that ‘by underestimating the danger … we add to the risk’. Over the last 500 years, there have been 16 occasions when a rising power has overtaken the dominant power. In 12 of them, war was the result.

It is dangerous to think that the US still dominates the world as it once did, given its global responsibilities, its diminished defence capability, its unpredictable national decision-making and the increasing strength of those that challenge it. This has monumental implications for Australian security when the US is still seen as the ‘centre pole’ of our defence.

The Coalition government’s spending on defence is wise, but a root-and-branch analysis resulting in an Australian national security strategy is the only way that Australia can assess whether our spend is enough, whether what we are buying is appropriate, and if we can afford to wait decades to rearm our military to deter conflict. The last thing we need is a new defence white paper. That would merely delay important decisions that are required now.

Given that anything in Australian defence takes decades to mature, an upcoming election is the perfect time to talk about the issue of defence and security.

The Australian Defence Force’s equipment is good and getting better. But the ADF’s current and planned force structures have some significant limitations in their ability to deliver some crucial military effects. In an era of strategic uncertainty, both in the threats we will face and in the capacity of our allies to help us face them, it’s useful to think about ways to address those limitations sooner rather than later. As always, the perfect (particularly when delivered sometime off in the never-never) is the enemy of the good. Also, given the strategic uncertainty, a future government will need to increase defence spending, or at least realise that its current investment plan needs some serious reviewing.

So what are those limitations? First, we are acquiring the conventional ‘A’ variant of the best tactical aircraft in the world, the F-35 joint strike fighter. But its range is limited even with air-to-air refuelling, particularly if we want a sustained presence in an area, rather than one that involves flying out, launching munitions and flying home. Once a naval or amphibious taskforce is more than 1,000 nautical miles (1,852 kilometres) away from our air bases, it’s pretty much on its own. A thousand nautical miles isn’t very far in the Indo-Pacific, or even in our patch of it in the South Pacific.

Second, our amphibious taskforce has only limited ability to provide fire support to lodged land forces. The short range of naval gunfire means that ships have to get close to enemy defences, leaving them vulnerable to the land-based anti-ship missiles we ourselves are interested in acquiring. The navy’s landing helicopter docks, Canberra and Adelaide, can carry the armed Tiger helicopter, but experience in Afghanistan and the Middle East shows that even relatively unsophisticated adversaries can make life very difficult for helicopters.

Third, our fleet has a very limited long-range land-strike capability. The Harpoon missile has some ability to strike land targets, but even our air warfare destroyers can carry only eight of them. We could put a true long-range strike weapon on one of the AWDs, but it will always be competing with air defence missiles for a home in the ship’s vertical launch cells. The future frigate will have more cells, but the first ship won’t be operational until at least 2030 and then they’re scheduled to come only every two years. The future submarine is not being optimised for strategic strike.

Fourth, our fleet has some ability to strike surface maritime targets. But Russian and Chinese anti-ship missiles have longer ranges than the Harpoon. The integrated investment program contains a project to acquire a more modern missile, but the number of vertical launch cells will always be a limitation, and ships can reload only back in Australia. Plus, if our missile can reach them, theirs can probably reach us. Submarines certainly have a serious anti-surface capability, but we’ve only got six of them and won’t get more for at least 15 years.

Fifth, adversary aircraft armed with long-range anti-ship missiles can launch them from outside the range of our defensive missiles. Our fleet can try to shoot down missiles coming at it, but it can’t stop enemy aircraft from repeatedly launching, returning to base and rearming.

All of this may not really matter if we’re confident that all we’ll need to do is plug into a US-led taskforce and rely on it to provide all of those missing elements. But if the challenge we’re now facing is that we may not be able to always and absolutely rely on the US to provide that support when we need it, then our force structure has a problem.

All the effects outlined above can be delivered by the F-35: close air support; defensive and offensive counter-air; and maritime and (with the right missile) long-range land strike. The problem is we can’t necessarily deliver the F-35 to where we need it.

How do we get the F-35, with its sensor suite, its data-sharing capability and its weapons load, into the fight—and, by doing so, allow the rest of the ADF to fight where we need it to?

One approach would be to get access to more airbases. But there aren’t many airbases capable of supporting the F-35 in our immediate region, and we’d always be reliant on host-nation support. Operating from an established land base also means the adversary knows where you are and, with the help of a spotter with a mobile phone sitting by the airbase, when you’re coming.

You know where this is going. Put the F-35 on a ship. But that’s only part of it. The suggestion is to acquire a squadron of the short take-off and vertical landing variant of the JSF, the F-35B, and a third LHD optimised to support air operations. What does that give the ADF? The bottom line is, a lot more options that the adversary has to deal with. Even in an age of space surveillance and electronic warfare, it’s harder to deal with an enemy airbase that’s moving.

Moreover, the F-35B doesn’t need to operate from a ship and can use a lot more airfields than the conventional JSF. It will be interesting to see where the resourceful US Marine Corps takes its F-35B as it learns to operate it. Is a Swedish approach, of operating from highways, on the cards?

I’m well aware of the threats posed by Chinese anti-access capabilities, and I’m not suggesting that having F-35Bs will mean that the ADF can go up against the Chinese fleet alone in the South China Sea. But I can’t see how a maritime or amphibious taskforce that includes an LHD with an F-35B is somehow more vulnerable than one without it. And if it’s too dangerous to send an F-35B–equipped LHD to sea, then it’s certainly too dangerous to send an LHD without the F-35B but with over 1,000 troops on it to sea. Moreover, the F-35B, whether operating from land or from an LHD, gives a lot of capability in scenarios short of full-scale war against China. A dozen F-35Bs flying two sorties a day, each with 24 guided 250-pound bombs on board, would provide a lot of close air support in an insurgency situation like that which unfolded in the Philippine city of Marawi, for example.

And in terms of options, if we’re in a scenario where we’re mainly concerned with a submarine threat, the third LHD could operate as an anti-submarine helicopter carrier and at the same time retain much of its original amphibious capability.

There are certainly other options Australia could consider, but it’s hard to think of alternatives that are available now. The new US bomber, the B-21 Raider, will provide a lot of the effects described above when it enters service, but it’s likely to cost around A$1 billion per aircraft. Unmanned combat aerial vehicles are coming, but they can’t do the whole job yet. A third Spanish-built LHD and F-35B squadron could be delivered in around five years (even with the modifications that allow it to carry all of those munitions and aviation fuel), well before the navy’s new frigates and submarines arrive.

Yes, the F-35B has a shorter range and a lower payload than the conventional variant the RAAF is already getting. But it has exactly the same sensor suite, sensor fusion and data-sharing ability. These make every asset in a taskforce better. When you really get down to it, the question is, would we prefer to have an F-35 with slightly less capability in the fight, or no F-35 and potentially no ADF in the fight at all?

In our first podcast for 2019, Marcus Hellyer and Malcolm Davis discuss China’s space ambitions and the progress of Australia’s naval shipbuilding program. Jack Norton catches up with Graeme Dobell to discover who won this year’s Madeline Award and Renee Jones asks the US Studies Centre’s Dr Gorana Grgic what the record US government shutdown is all about. You can view links to the articles mentioned in this week’s episode here.

What would we say if Washington asked to base nuclear-armed missiles, aimed at China, on Australian territory? It’s not an entirely hypothetical question. Amid all the talk of a new cold war with China, the strategic logic of America’s plans to withdraw from the Intermediate-Range Nuclear Forces (INF) Treaty plainly suggests that such a request is a real possibility.

If the request comes—and it could come quite soon—Australia would face a truly momentous choice. If we agreed, our relations with China would face a crisis far, far worse than the recent chill from which the government has been working so hard to extract us. To refuse would be to abandon our ally in what everyone in Washington now sees as the decisive strategic contest of our time. Either way, Canberra’s fragile effort to avoid taking sides in the epic contest over the future of Asia would be smashed.

To see why this possibility looms, we have to go back to the INF Treaty and America’s reasons to withdraw. China wasn’t a party to the bilateral agreement reached in 1987 between the Soviet Union and America to ban missiles with ranges between 500 and 5,500 kilometres. But it has been clear that the US decision to withdraw is as much or more about China as about Russia.

Moscow has violated the treaty by building new missiles that contravene its terms, but Beijing has never been constrained from building such weapons, and it now has thousands. Thanks to the treaty, America has none, but now, as the contest with China becomes America’s primary strategic focus, Washington wants to be able to match Beijing’s intermediate-range missiles with equivalent forces of its own. That’s a key reason why it wants to scrap the treaty.

Matching Beijing’s intermediate-range missiles with similar forces is seen to be important to Washington because of a fear that China’s intermediate-range forces will undermine the credibility of America’s nuclear deterrent in the Western Pacific. It’s the same fear that drove America to deploy intermediate-range nuclear missiles to Europe in the 1970s and 1980s, to counter the Soviet SS-20 missiles that threatened Western Europe.

The worry then was that the Soviet SS-20s could threaten Western Europe with impunity if Washington didn’t have similar systems, and had to rely instead on US-based intercontinental-range missiles to counter them. It was feared that Washington would be deterred from using those forces because that would provoke a massive Soviet counterattack on the US homeland. So, to deter the Soviets and reassure its European allies, America based intermediate-range nuclear missiles in Europe until, as the Cold War wound down, US President Ronald Reagan and Soviet leader Mikhail Gorbachev agreed to ban such forces altogether.

Now that Washington’s strategists recognise that the US is in a new cold war with Beijing, they want to base intermediate-range nuclear forces in the Western Pacific for the same reasons. They are starting to take China more seriously as a nuclear adversary, and they worry that the possibility of a Chinese counterattack on America itself might undermine the deterrent credibility of their intercontinental-range forces. They worry both that China will be less convinced than they have long assumed of America’s nuclear advantage, and that that will lead Asian allies to doubt America’s commitment to defend them from Chinese nuclear threats.

Those worries are not without some foundation. In South Korea, there’s an active debate about the need to develop an independent nuclear capability. Japan’s doubts about America’s reliability as an ally are real and growing. And conversations with US policymakers and analysts suggest that some in Washington have been surprised and somewhat alarmed by the way that doubts about America’s reliability have sparked a debate here on The Strategist and elsewhere about whether Australia needs to consider nuclear options, suggesting that we too are losing faith in America.

This is bad news for Washington as it gears up to contest China’s bid for regional hegemony in Asia. America will need these allies, and that means they need to be convinced that the US is a credible and reliable nuclear ally. And many in Washington seem to have decided that deploying intermediate-range nuclear forces to the territories of its Asian allies is the best way to do that.

It’s far from clear that this is true. The whole INF issue deals only with land-based missiles, and America has plenty of options to deploy sea-based nuclear forces to Asia—just as it had in Europe in the 1970s and 1980s. The land-based INF deployment to Europe was a political gesture aimed at reassuring nervous Europeans, and made little real difference to the nuclear balance in Europe—as many Americans recognised at the time.

But more importantly, deploying intermediate-range nuclear forces—whether land or sea based—would not fix the underlying weakness in America’s nuclear posture in Asia. That’s because the problem with that posture is not a lack of intermediate-range weapons but a lack of clear resolve to accept the risks to America itself of using them to attack China.

Those risks are very real. Unlike the old Soviet Union, China has no major military assets beyond its own territory, so the only targets worth hitting with nuclear forces would be in China itself. Any nuclear attack on Chinese territory—whether launched from within Asia or from the US—would carry a serious danger of Chinese nuclear retaliation against American territory.

Some strategists in the US assume that Beijing could be deterred from such retaliation by fear of a full-scale American counterstrike, but that can’t be taken for granted. And no one in Washington seems ready to argue that America’s desire to remain the primary power in Asia is worth the million American lives that might be lost in a Chinese nuclear attack on the US. That is one key difference between the old Cold War and the new one. There was little doubt that America was willing to suffer a nuclear attack to contain the Soviets, but no one has made that case about China.

Even so, the push to build and deploy land-based intermediate-range nuclear forces to Asia is now gaining momentum in Washington, and raises the question of where they would be based. The only US territory in the region is Guam, which is already highly vulnerable. The whole logic on INF deployment suggests that Washington will be looking to locate these forces with its allies in the Western Pacific.

That means before too long we can expect a preliminary approach about whether we would be willing to host some of them here. It would make a kind of military sense. Missiles at the upper end of the intermediate-range band based in northern Australia would be able to reach most of China, and would be much more secure from Chinese preemptive attack than missiles based in South Korea or Japan.

But to many in Washington, the real point of putting this request to Canberra would be political rather than strategic. It would not just be about reassuring Australia of America’s reliability as an ally, but also about testing Australia’s commitment to stand by America in the new cold war with China.

It cannot have gone unnoticed in Washington that Canberra has so far failed to endorse America’s new tough line on China, and is still trying desperately to avoid choosing sides between our major ally and our primary trading partner. That is not what Washington wants or expects. It wants us to choose sides unambiguously, and what better way to force that choice than to ask us to host nuclear missiles aimed at China?

The risk for the US, of course, is that we might not make the choice it wants. We might say no.

Originally published 20 September 2018.

The relationship between the Australian and Chinese governments would benefit from a clearer declaration from Australia about what is and is not in our national interest in engaging with the Chinese state and economy.

This is a particularly timely requirement given that President Xi Jinping’s re-energised Communist Party has clarified the Chinese state’s intent and behaviour in ways that show that the time of its peaceful rise is over.

A declaratory policy is just a way of saying what you do and don’t want, and what you will and won’t do, so that others know what to expect and can shape their own policies and actions accordingly.

Such a clear policy can be implied from government decisions and statements and from laws passed by the Australian parliament. Rather than leaving it to be understood from the pattern of individual decisions, a statement setting it out simply would provide a framework to help manage future issues.

Without such a framework, each Australian decision can be characterised as a new ‘test’ of the bilateral relationship—whether on foreign investment, security or defence relations, or on whether to prosecute foreign interference or implement, say, the laws regulating research partnerships.

Each decision can look like a chance to send a message, or to give a little back if the previous one was maybe perceived as harsh. That creates the risk of an ad hoc transactional approach. Commentators and critics then read the tea leaves of each decision for symbolism about overall policy directions and the ‘state of the relationship’.

It makes everything a more febrile, exciting and open adventure than a more sober analysis would suggest. Great for the commentariat, but bad for government to government relations.

Let’s look at overall policy settings and big decisions on China and what declaratory policy flows from them. First on foreign investment and trade.

Australia is open for business. Our two-way trade with China focuses on resources, agriculture and services (notably tourism and education). This is mutually beneficial, as Australian businesses earn strong revenue and our Chinese customers receive world-class resources, goods and services at competitive prices.

But economists and strategists learned from the global financial crisis that it’s a mistake to carry too much risk in any asset area.

So, Australia will seek to diversify its economic and trade relationships to reduce its reliance on China as the single customer.

Trade diversification is an old strategy for Australia that’s becoming newly relevant. It was a major theme when the UK joined the European Economic Community—another example of our reliance on a large single customer being bad economics and bad strategy.

Peter Varghese’s India strategy sets out the contribution that a growing relationship with India can make to such diversification. Prime Minister Scott Morrison’s visit to Indonesia around the free trade agreement is another element of that strategy.

On investment, most foreign investment into Australia, whether from China or elsewhere, is approved by the Foreign Investment Review Board process. According to FIRB annual reports, in the 10 years to the end of 2016–17, four business proposals were rejected (two on Ausgrid, one on Graincorp and one on the ASX) and 169,178 were approved.

The small number of foreign investment decisions rejected (and others given a ‘preliminary view that they were contrary to the national interest’) from Chinese entities are important, however, in establishing a policy. Key examples are the Ausgrid decisions and the Kidman Holdings decisions. In the Ausgrid case, Chinese bids were rejected as contrary to the national interest.

In the case of Kidman Holdings, in April 2016 the then treasurer, Scott Morrison, gave his ‘preliminary view’ that the original bid from Dakang Holdings, a Chinese-owned entity, was contrary to the national interest. That meant that if it proceeded, it was very likely to be rejected. A new bid involving Gina Rheinhart and a Shanghai firm was accepted, with property straddling the sensitive Woomera Prohibited Area in South Australia excised from the transaction.

There’s little doubt that if the leasing of Darwin port was being decided in 2018, the Chinese entity Landbridge would not have got its 99-year lease.

On telecommunications infrastructure, the government has advised Australian telcos that suppliers subject to extrajudicial control by governments won’t be able to supply 5G systems within Australia. That has excluded Chinese telcos Huawei and ZTE.

Public statements on our approach to foreign investment review and critical infrastructure are reassuring about openness to investment and explain in detail that any rejections are decided case by case, subject to the nature of the asset and transaction, with no one-size-fits-all approach. That repeats the longstanding approach of testing all foreign investors’ proposals against Australia’s national interest.

But these public statements provide scant explanation of the few important rejections.

The sense I make of it—and which I’m sure the leadership in Beijing gets too—is that we’ve reached a point in Chinese investment in Australia’s critical infrastructure, energy and communications sectors where further aggregation and large market penetration by Chinese-owned entities is not seen as being in our national interest.

As with trade, this is probably as much about cumulative business risk from reliance on a single source of investment as it is about strategic interests. The net effect, though, looks pretty firm from a policy perspective. Let’s say so.

Second is the new foreign interference legislation. As Malcolm Turnbull said when he introduced it last December: ‘[Q]uestions of foreign interference are not all about China—far, far from it. Globally, Russia has been wreaking havoc across the democratic world.’

But it’s equally clear that events like the controversy over former senator Sam Dastyari, combined with testimony on the threat from foreign interference and covert influence by the head of ASIO, created the foundation for this legislation to be passed by both sides of politics.

The policy here is in the law itself. Quoting Malcolm Turnbull again: ‘Media reports have suggested that the Chinese Communist Party has been working to covertly interfere with our media, our universities and even the decisions of elected representatives right here in this building. We take these reports very seriously.’ He also said: ‘[W]e will not tolerate foreign influence activities that are in any way covert, coercive or corrupt. That is the line that separates legitimate influence from unacceptable interference.’

The only further clarity we could provide is to prosecute a Chinese national for covert interference or espionage. That may come, noting that both Russia and the US do often prosecute Chinese nationals for such things.

Lastly, there’s the issue of the defence relationship and the pursuit of capability advantage by the ADF and by the PLA. Here also there’s some clarity. We seek a defence relationship where we can engage each other to increase understanding, and we each seem willing to exercise together in ways that don’t give away real capability insights.

There’s no prospect of the Chinese giving us technological or intelligence insights into the PLA’s weapons systems, cyber capabilities or even strategic intent (apparently they don’t conduct cyber espionage for economic advantage now).

Similarly, Australia won’t share JORN over-the-horizon radar, CEA radar, or the joint strike fighter or future submarine technologies with the PLA. That’s because we are not allies and we have markedly different strategic interests. We each know that it’s not in either of our interests to advance the military reach and capabilities of the other. Again, let’s say so.

That will have consequences for research partnerships and for particular types of students in Australian universities. China would never allow Australia (or the US, Japan, France, Germany, the UK …) to put military or other national security individuals in its key military research institutions or in universities that are creating the next wave of technical advantage (with both civil and military applications).

Australian policymakers, universities and the public need a much clearer, more honest and intellectually rigorous discussion about what the Chinese military and the research community tied to that military are seeking to achieve here and in other nations through their research partnerships and student placements.

To date, the Defence Trade Controls Act 2012 seems to have resulted in not one refusal of a research proposal involving the Chinese military on national security grounds, maybe because it relies on universities’ self-assessment of national security risk.

Doctoral and post-doctoral researchers from China who have access to cutting-edge research in STEM that has military applications will apply that knowledge for PLA purposes. We’re fooling ourselves if we think that PLA students studying explosives technologies or quantum computing would be doing so for peaceful purposes.

Given Xi’s agenda of using civil–military fusion to create strategic and military strength through next-generation technologies, it’s hard to see that research partnerships contributing to the PLA’s capability agenda are in our national interest.

A clear declaratory policy on China around economics and security would look a bit like this:

If such a declaratory policy were in place, Australian ministers wouldn’t be as hostage to pressure (as much from the various wings of Australia’s commentariat as from Chinese authorities) on individual decisions.

As an example, the treasurer’s forthcoming decision on the bid by CKI holdings to acquire a large stake in Australian electricity and gas distribution systems would already be clear—and future such bids would be unlikely.

Let’s take the heat, light, noise and excitement out of the relationship by establishing a clear, declared policy that governs our approach to the economic and strategic relationship with the Chinese state. It won’t be new news to Beijing and the CCP leadership, but it will make our government’s deliberations and public statements easier.

It will also be a welcome relief to both sides of politics to have a clear bipartisan approach.

This may well encourage similar clearer declarations from other nations facing similar tensions and competing interests in their own relationships with the Chinese state and economy.

In February, New Zealand Foreign Minister Winston Peters announced a revised approach to the Pacific islands. Central to the coalition government’s ‘Pacific reset’ was a pledge to increase New Zealand’s diplomatic and development footprint in the region. This included a NZ$714 million boost to aid and development spending, as well NZ$180 million for a new strategic international development fund.

Since then, there has been a raft of developments. The government’s May budget provided New Zealand’s foreign service with a significant boost in funding. The government’s strategic defence policy statement, released in July, was noteworthy for its unusually frank language about China’s actions. And last month, Peters announced the creation of a $10 million Pacific fund that will operate beyond the parameters of formal aid arrangements and an increase in the number of staff posted offshore in the Pacific.

New Zealand’s relationship with China, and the rewards it has brought, are well known. The country is now NZ’s largest trading partner in goods, and second largest when services are included. The dairy sector, especially, has profited immensely; it currently supplies over 80% of China’s butter imports and over 50% of its cheese imports.

The government’s hike in aid funding, change of tone and upgrade of maritime patrol capabilities are soft-power responses to a mounting dilemma: how to counter China’s escalation of influence in the South Pacific.

The Belt and Road Initiative, which was first unveiled in 2013, is at the heart of Beijing’s growing presence. In its simplest form, the initiative is President Xi Jinping’s grand plan to boost China’s trade links across Eurasia. China has deployed hundreds of billions of dollars—often through loans or financial guarantees—to other countries for big infrastructure projects. The ambition of the BRI is enormous: it targets, by one estimate, about two-thirds of the world’s population, a third of global GDP and a quarter of all trade.

New Zealand signed a non-binding memorandum of arrangement with China on the BRI in 2017—one of the first Western countries to do so. However, looking at what was signed, it’s hard to find anything out of the ordinary. Collaboration in mutually beneficial areas such as education and tourism has been going on for many years.

Stephen Jacobi, the executive director of the New Zealand China Council, is arguably most vocal advocate of BRI involvement in New Zealand. According to Jacobi, trade flows, not infrastructure, are ‘the real play’ in the region. Yet some believe that Jacobi is too optimistic and he very rarely offers a critical word on the strategic goals the BRI is seeking to achieve.

Sri Lanka’s BRI experience shows how things can go wrong. In December 2017, having failed to pay accumulated debts to China, the country handed over its strategically located Hambantota Port in a debt-for-equity swap. Given that the economic rationale for the port is weak, there’s been a great deal of speculation that it could become a Chinese naval facility.

China’s aid investments in the Pacific, which lag well behind Australia’s, stand out because they often involve high-profile projects. Through the BRI, for example, China has pledged an eye-watering US$3.5 billion to build a new road network in Papua New Guinea. On the other hand, Australia and New Zealand have historically invested in areas such as education and training for better governance. Similar to what happened in Sri Lanka, Canberra and Wellington fear that countries in the region will be snared in ‘debt traps’ which will be exploited by China.

Closer to home, Peters’ cash injection hasn’t deterred Beijing. In fact, China has responded by simply upping its own involvement. In recent months, Niue and the Cook Islands—whose citizens carry New Zealand passports—have made commitments to join the BRI. While both have a degree of autonomy, Wellington has tended to lead when it comes to foreign policy.

At the APEC conference in PNG, New Zealand’s ‘soft power’ push was on show. Prime Minister Jacinda Ardern announced that New Zealand would join the US, Japan and Australia to expand access to electricity in PNG. There was also an announcement, by Peters and his Australian counterpart Marise Payne, of a joint cybersecurity project with Pacific island countries.

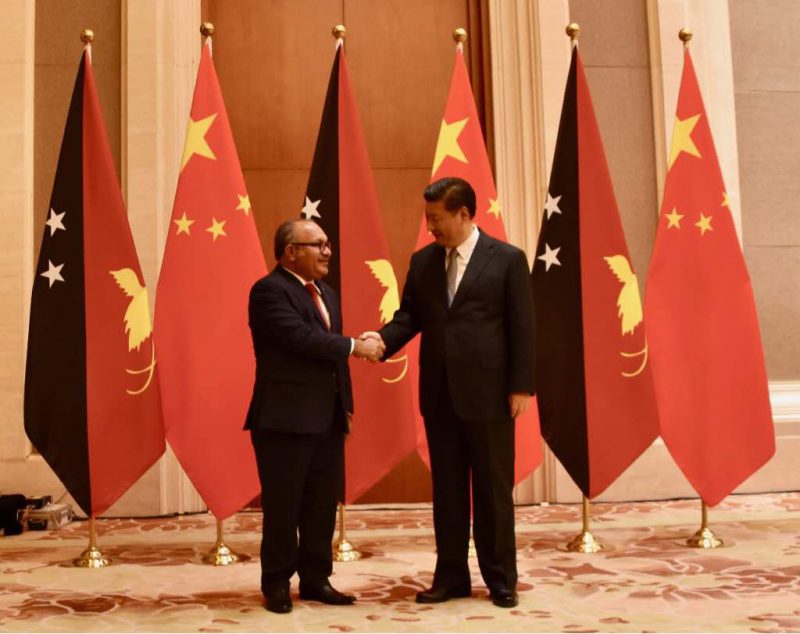

If Trade Minister David Parker’s comments at APEC are anything to go by, New Zealand’s strategy is to act as an ‘honest broker’ between China and the US. But the geopolitical tensions that bubbled up at the summit—mainly over who would be the better investment partner for the region—underline how that spot might be difficult to maintain. Xi’s meeting with eight Pacific leaders and Tonga’s signing up to the BRI indicate that China is upping the ante.

On her return from PNG, Ardern reiterated Parker’s comments, saying that New Zealand’s approach was based on principles and not aligned with any one country.

Last month, the government turned down Spark Telecom’s proposed use of Huawei equipment in New Zealand’s 5G network on the advice of its main intelligence agency. Andrew Little, the minister responsible for the Government Communications Security Bureau, is yet to go into any detail on why the company’s involvement would create a national security risk.

With an upgrade of the NZ–China free trade agreement on the cards, this was a tough call for the government—though the language in China’s 2017 national intelligence law probably made the decision easier. Article 7 of the law makes it clear that Chinese organisations are expected to collaborate in national intelligence work. More generally, the government’s caution is understandable, especially given the scale of cyber theft undertaken by groups linked to the Chinese state.

In the past year, New Zealand’s foreign policy has become more cautious towards China. To counterbalance the Chinese thrust into the South Pacific, Wellington appears to be shifting back to its traditional ANZUS partners. The Huawei decision looks to be an indicator of the government’s willingness to speak out against China, even if it is the line that Beijing doesn’t want to hear. It will be interesting to watch how this shift in policy plays out, especially given the fluctuations that could come with the unusual nature of the coalition government in Wellington.

Observers outside of Papua New Guinea may find it a somewhat puzzling exercise to try to pinpoint PNG’s position on the current geopolitical manoeuvrings between the United States (and its allies) and China. What factors define PNG’s interactions with the various parties in this rivalry? The crudest way of answering that question is: PNG’s foreign relations have to be understood in the context of PNG’s domestic politics and the perceived benefits of those relations.

On the whole, PNG’s foreign relations are not informed by any rigorous process of foreign policy engagement with domestic stakeholders and interest groups. What is touted as PNG’s interest isn’t necessarily the product of a serious refining of priorities. PNG’s official foreign relations are determined mainly by personalities and circumstances or perceived material benefits, rather than by any distinctive decision-making structure.

Cabinet and ministerial prerogative in most instances frames how foreign policy agendas are executed on behalf of the Independent State of PNG. References to cornerstone foreign policy ‘principles’ are made, but often as an afterthought. Domestic players, if they exist at all, are disconnected from the foreign-policymaking process.

The latest move to build a naval facility with Australia in Manus province provides a good example. It is the first time since independence that a facility housing foreign powers will be constructed in PNG. The agreement to have a joint naval base on PNG territory faces a ‘democratic deficit’ because Papua New Guinean input was never sought, yet it is Papua New Guineans who will live with the impact. Allan Gyngell and Michael Wesley note that ‘foreign policy making is a realm of government that needs to be subjected to a greater amount of public accountability and transparency’. The Manus naval base agreement is a foreign policy strategy that doesn’t reflect Papua New Guinean designs.

Already, there are objections to the decision by political leaders of Manus, who feel that the province’s people weren’t consulted on the matter. The PNG government’s decision to be party to a joint naval base agreement was never debated in parliament, even though that is the highest law-making body in the land with the power to ratify international treaties and agreements. The parliamentary committee on foreign affairs is ineffectual and has never been allowed to consider submissions from the public on issues such as the naval base.

Two previous Australia–PNG cooperation arrangements—the 2004 enhanced cooperation program and the 2013 deal to process asylum seekers on Manus Island—were belatedly ruled unconstitutional by the PNG Supreme Court. Australian engagements with PNG have an unsavoury history of bypassing initial domestic scrutiny.

The fact that these landmark bilateral arrangements were found to be unconstitutional attests to deficiencies in domestic scrutiny and debate. Checks and balances on national positions in PNG’s international commitments are dispensed with. It is an efficient way of keeping Papua New Guineans passive and reliant on external forces and the all-knowing executive arm of government.

I am tempted to argue that the competing powers in the Sino-American rivalry are capitalising on the weaknesses in PNG’s domestic scrutiny of foreign policy and an uninformed populace to advance their own agendas.

Without the input and constructive participation of Papua New Guineans, our country’s position on international matters will further erode democratic processes and ultimately the sovereignty of PNG. If PNG’s partners are serious about helping us build on our common values of adherence to the rule of law and democratic principles in decision-making, the same level of participation that American and Australian citizens enjoy has to be encouraged for PNG.

This may mean demanding that the PNG government show cause on the level of domestic input into a serious issue like a naval base on PNG territory. The US and Australia should make adequate consultation with the people of PNG a condition for agreements on issues that will profoundly affect them.

In Western democracies like Australia and the US, foreign policy is an outcome of a range of alternatives, and the participation and influence of domestic interest groups and actors is pronounced. In Australia, for instance, the media is an agenda-setting stakeholder. Non-government organisations; advocacy and lobby groups; political parties; research think tanks wholly committed to informing foreign-policy positions; and a multiplicity of interest groups and individuals make the process of foreign-policymaking a rigorous and sometimes protracted affair. Moreover, foreign policy is a serious item in the electoral cycle, not least when it comes to decisions like whether or not to go to war. It’s not unheard of for political parties and candidates to either win or lose based on the foreign policy platforms they align with.

Voters in industrialised democracies are often also tax-paying citizens. Taxpayers invariably vote with the assumption that their tax dollars will be spent on policies and programs that are consistent with their interests. In foreign relations, taxpayers prefer certain levels of accountability. The Australian and New Zealand governments, for example, are exacting when it comes to reassuring taxpayers about the quality and transparent delivery of their foreign aid to countries like PNG.

It is these processes and institutions in Western democracies that directly connect the citizen to foreign-policymaking processes, and make foreign policy relevant to the average citizen.

It is therefore misleading to assume that the same kind of connection of the citizenry to the foreign policy apparatus exists in developing democracies like PNG. PNG’s parliament is dominated by the executive. In a political system where elected officials are focused on more parochial and tribal matters and concerned with the immediate chores of pork-barrel politics, foreign relations is a sideshow preoccupation over which the cabinet, the prime minister and the Ministry of Foreign Affairs have significant influence.

Western powers in the region that wish to enlist the diplomatic support of PNG in countering non-democratic powers ought to be mindful of the domestic dynamics of PNG’s foreign policy decision-making processes, to help nurture inclusive values. Western countries that are governed according to democratic principles should look no further than their own political systems and the standards to which their citizens and interest groups hold their elected leaders.

Since the Cold War ended, the West has invested huge amounts of resources in efforts to induce political liberalisation in China, including through programs to promote the rule of law, civil society, transparency and government accountability. The results have been disappointing. Far from becoming more democratic, China has lately been backsliding towards hard-line authoritarianism. And now it is investing resources in efforts to do some inducing of its own in the world’s democracies.

China’s influence-peddling in the West has been the subject of media reports and think tank studies and has elicited the concern of high-profile politicians, from US vice president Mike Pence to former Australian prime minister Malcolm Turnbull. China’s ‘influence operations’, they argue, include cultivating ties with Western politicians, establishing Confucius Institutes around the world to promote Chinese language and culture, expanding the global reach of China’s official propaganda networks, and making donations to and setting up exchange programs with academic institutions.

How should Western liberal democracies confront a China that is taking a page from their own playbook, as it exploits their openness to advance its ideological and geopolitical objectives?

For starters, Western leaders and institutions should distinguish between state-sponsored activities and legitimate, mutually beneficial cultural, civic and educational exchanges among private citizens and entities.

To be sure, the Chinese Communist Party’s sophisticated ‘United Front’ operation—which focuses on neutralising opposition to its policies and authority, inside and outside China—often relies on private citizens to achieve its objectives. Private actors also have informal incentives to curry favour with China’s rulers by behaving in CCP-friendly ways. As a result, even ostensibly independent or private activities can carry political and reputational risks for Western organisations, which may be accused of acting as ‘agents of influence’ for China.

But that doesn’t mean that Western entities should reject outright any opportunity for cooperation with Chinese entities and individuals. Such an approach would not only cause Western organisations and individuals to miss out on valuable opportunities; it would also strengthen the CCP’s capacity to control the flow of information, manipulate public opinion and shape popular narratives.

So while the West must exercise vigilance, it should avoid overreaction. A donation from a Chinese state-owned enterprise to, say, a Western academic or cultural institution must be handled with extraordinary care, if not rejected outright, because it could compromise the recipient’s reputation or constrain its freedom. But a gift from a wealthy Chinese businessperson should be welcomed, as long as it is transparent and includes no conditions that would infringe on the recipient’s mission.

In fact, transparency is one of the most powerful mechanisms for protecting Western democratic processes from Chinese influence operations. For example, public-disclosure requirements regarding the sources and conditions of donations to politicians, political parties, and civic and academic institutions, as well as ownership stakes in media assets, would make it much harder for the Chinese government to exert its influence through ostensibly private actors. A shared code of conduct for dealing with China would also help to ensure that democratic values are upheld in any deal or collaboration.

Upholding these values also means that Western governments must take care to avoid another kind of overreaction: targeting their societies’ own citizens of Chinese origin. Given China’s long record of exploiting its diaspora for economic and political gain, some in the West will be tempted to look upon all ethnic Chinese with suspicion, exposing them to discrimination and potentially even subjecting them to surveillance.

But allowing ethnic Chinese to be harassed, intimidated or punished for exercising their civil and political rights—say, by making political donations or speaking out on issues that matter to them, including those related to China—would be a grave injustice. It would also be self-defeating strategically: the soft but intense power of the democratic values that the West claims to defend constitutes the most effective defence against Chinese influence operations.

Western institutions benefit from unparalleled resilience, thanks to the liberal-democratic values that underpin them. They cannot be easily subverted by an authoritarian regime, no matter how many cultural exchanges or language institutes it builds. In fact, what is most notable about China’s efforts to spread its influence abroad is not their success, but the ease with which they are exposed. Portraying them as a genuine threat to the world’s democracies not only betrays the West’s own insecurity, but also gives China more credit than it deserves.

The first strategic priority for Australia in the Indo-Pacific is to manage great-power competition. And the central trend of that competition is the challenge to US dominance.

So says Australia’s defence minister.

Here’s Christopher Pyne describing the regional race:

We see today that the relationships between the great powers of the region are becoming more competitive. There are worrying signs of a return of ‘might is right’. That is just one of the reasons we regard the United States as our most important security partner. For decades, it has used its considerable power to sponsor rules and institutions that have benefited countries of all sizes and provided the stability that has allowed this region to grow into the engine room of prosperity and growth it is today. But the United States will find it increasingly difficult to provide this security unchallenged—and frankly we should not expect it to underwrite that security alone.

Australia’s responses, as listed by Pyne:

The terrorism point is the category outlier. Everything else leans towards Pyne’s first priority—managing great-power competition. Cast your mind back to the way the previous decade was defined by terrorism. Talk about a shift in strategic focus.

The sense of a new era arriving is the launch point of the Regional security outlook 2019 from the Council for Security Cooperation in the Asia Pacific.

As Ron Huisken writes in the volume’s introduction, we face a change likely to have major and enduring consequences for stability and order: ‘the end of ambiguity and denial about whether the United States and China saw themselves as in an essentially adversarial contest for global preeminence’. He links a ‘decisive shift’ in America’s attitude to the judgement that ‘the challenge of adapting the global order to accommodate a powerful China is proving too hard’.

The US and China may yet surprise us with concessions and initiatives, Huisken writes, but the two states can no longer credibly assert that they have everything under control:

An overtly adversarial relationship between America and China is precisely the outcome that everyone has been seeking to avoid over the past 30 years. Such a development was first mooted in the late 1980s as a theoretical possibility suggested by history. Since the turn of the century, it has evolved from a detectable tendency into an increasingly probable outcome.

Giving the CSCAP view from Washington, Lindsey W. Ford reports on a sharp-edged US embrace of strategic competition:

Two years after President Trump’s election, most of the worst fears about what a Trump presidency might mean for Asia have not been realised. The United States remains engaged in the region, focused on maintaining alliance relationships, and committed to creating greater freedom and openness.

But the administration’s shift toward a more openly competitive US–China relationship suggests that US strategy may be on the precipice of a significant, and potentially longer-term, realignment.

From Shanghai, Zhong Zhenming says the US–China relationship is being transformed:

[A] vicious competition between China and the United States may lead to the two countries trying to please other countries in the Asia–Pacific region, and some will try to benefit from their strategic competition by playing one off against the other. The dynamics of great power competition will worsen the ecology of international relations in the region. China and the United States will find it costly to compete for allies, partners or friends. More importantly, some countries are likely to be victims of Sino-US competition as their national interests are discounted and priority given to power rivalry.

From Tokyo, Masayuki Tadokoro offers key questions being quietly debated in Japan: ‘Is the US still a reliable ally? How do we balance China and hedge against the erosion of the alliance?’ And in the classic Japanese manner, the professor’s article ends on those questions.

They’re good questions, though, as decision-makers and thinkers in Canberra would agree.

The new era of great-power competition has arrived. Now to work out how it’ll work and where it might go.

The Quadrilateral Security Dialogue (commonly known as the Quad), an informal grouping comprising the United States, Japan, Australia and India, made a return in 2017. Have the Quad’s prospects improved after it failed to take off when it was first introduced in 2007?

The answer is a qualified yes. The main reason for this positive reading is the emergence of the Indo-Pacific strategy in the regional security discourse. The relevance of the Quad is augmented as the states within it and beyond begin to form their security policies based on the Indo-Pacific geographical concept. The Quad could serve as an enabler to strengthen security cooperation among its four members, as well in other bilateral, trilateral and multilateral arrangements in the complex regional security architecture.

The region is facing rising uncertainty. China’s reclamation and militarisation of reefs and islets in the South China Sea, the stand-off between India and China in Doklam, and the denuclearisation of the Korean peninsula are just some of the key strategic issues that regional states are concerned with.

At the macro level, the US–China competition has intensified, as witnessed in the escalating trade war. While China has benefited from participating in the US-led postwar order, it is also clear that the rising power prefers to reform the order to suit its interests. Beijing is pushing an ambitious agenda involving the formation of China-led projects such as the Belt and Road Initiative and the Asian Infrastructure Investment Bank. Concerns also stem from the Trump administration’s ‘America First’ and anti-globalisation policies, as well as its questioning of the value of alliances in Northeast Asia.

The potential revision of the East Asian regional order brings strategic uncertainty, especially in relation to the US’s role, China’s intentions, and the strength of ASEAN’s unity and centrality in the region.

The entry of the Indo-Pacific concept into the regional discourse has had two important consequences. First, the strategic theatre for the US and its allies and partners is increasingly being defined by a wider geographical lens, beyond East Asia. This broadening increases the strategic importance of India and Australia in ensuring stability in the region alongside the US and Japan.

Second, as a counter to the ‘US is in decline’ narrative, the Indo-Pacific focus prolongs US-led predominance and leadership in the region. The US military changed the name of its Pacific Command to Indo-Pacific Command, highlighting both the influence of the Indo-Pacific notion on strategic policy and America’s intent to preserve the US-led order in the Indo-Pacific region.

With the rising prominence of the Indo-Pacific strategy, it’s no surprise that the Quad made a return in 2017. Officials from the four countries have held two meetings since 2017, which is notable progress after a 10-year hiatus. All four nations support the ‘free and open Indo-Pacific’ theme, albeit with some variations between them.

The Quad serves as a convenient platform for the four members to come together. The fact that it is a small, informal arrangement made up of like-minded states makes it relatively easy for them to engage effectively in security cooperation.

The Quad acts as an enabler in two specific situations. First, it allows the four states to build confidence in security cooperation based on mutual trust, common values (such as to maintain a ‘free and open Indo-Pacific’), and a shared vision of regional and international order.

Second, it strengthens cooperation through other multilateral security arrangements in the region. All four countries are integrated into the ASEAN-led regional security architecture through their status as dialogue partners of ASEAN. They are members of the ASEAN Defence Ministers’ Meeting-Plus, the East Asia Summit, and the ASEAN Regional Forum. They are also members of the US-led Rim of the Pacific biennial naval exercise.

At the same time, the four members are engaged in bilateral and trilateral security initiatives. The Quad could not only exist alongside these security arrangements, but work with them to ensure regional stability.

No doubt, several challenges remain that could hamper the Quad’s effectiveness. These include the strength of the members’ political will for supporting the Quad (especially in India), the varying threat perceptions held by the four states, and ASEAN’s concerns about the Quad.

Regardless of the much-discussed weaknesses, the time is ripe for the Quad in the Indo-Pacific era. However, it will be most effective if it remains an informal enabler of security cooperation in the ASEAN-led security architecture.