Nothing Found

Sorry, no posts matched your criteria

Sorry, no posts matched your criteria

ASPI celebrates its 20th anniversary this year. This series looks at ASPI’s work since its creation in August 2001.

The list of 14 grievances issued last year by China’s embassy in Canberra had one point aimed at ASPI.

Among the sins of the Australian government, in the eyes of China, was to fund an ‘anti-China think tank for spreading untrue reports, peddling lies around Xinjiang and so-called China infiltration aimed at manipulating public opinion against China’.

The aggrieved and annoyed tone was also an acknowledgement: the institute’s research was having an impact. Beijing’s growing cyberpower had made China a natural focus for the work of ASPI’s International Cyber Policy Centre.

As ICPC’s director Fergus Hanson noted in March 2020: ‘The simple act of looking at what the Chinese government says it wants to do and is doing has produced some remarkable empirical research and insights into the type of state that Australia, and the world, is dealing with.’

Chinese anger at what’s been revealed produced unusual pushback, smear campaigns and cyber-enabled interference targeting ASPI and individual staff members. Tackling state-backed information operations and disinformation can also make you a target.

In Enter the cyber dragon in 2013, Tobias Feakin wrote about the cyber capabilities of Chinese intelligence agencies and their ‘industrial scale’ operations.

While Chinese agencies were collecting vast quantities of data, Feakin said, ‘what happens to it once it’s collected is relatively unknown. We’re not certain how the data is processed and analysed, and whether it ever becomes a fully usable intelligence product that’s of value to Chinese policymakers’.

A deeper understanding of what China was doing in the cyber realm, Feakin wrote, would shape Australia’s own policy settings.

A 2014 report on China’s cyberpower by James Lewis dismissed claims that China was waging an economic war in cyberspace. China’s behaviour, he wrote, had more to do with commercial interests than geopolitical strategy:

China’s cyber doctrine has three elements: control of networks and data to preserve political stability, espionage to build China’s economy and technological capabilities, and disruptive acts aimed at damaging an opponent’s military command and control and weapons systems, all of which are dependent on software and networks.

ASPI staff and contributors to The Strategist debated whether the Chinese telecommunications company Huawei should be allowed a role in Australia’s 5G network, tackling the broad Australia–China relationship, other states’ experience with Huawei, the Chinese government’s approach to cyber espionage and intellectual property theft, and the Chinese Communist Party’s view of state security and intelligence work.

In August 2018, the government banned China’s Huawei and ZTE, stating that ‘the involvement of vendors who are likely to be subject to extrajudicial directions from a foreign government that conflict with Australian law, may risk failure by the carrier to adequately protect a 5G network from unauthorised access or interference’.

It was a key moment in the dawning of an icy era in Australia’s relations with China.

The anger that China directed against ASPI was based on the detailed work of the cyber centre and the facts it revealed about Chinese policy and behaviour:

In 2020, Hanson responded to criticism that ASPI’s research on China was ‘one-sided’ and ‘dystopian’. He noted that Australia had put lots of effort into understanding China’s economy, but other critical areas were ignored, such as technology transfer programs, united front activities, military modernisation and interference in diaspora communities:

ASPI has one of the largest concentrations of Chinese-language speakers in any think tank in the country. Their specialisations include China’s military, technology transfer, online censorship, smart cities, social credit and industrial espionage. Our China research runs across different thematic programs and, while it attracts attention, is still only a modest part of ASPI’s total research output.

Hanson said ASPI didn’t have an editorial line on China, but it did follow a very clear research method: original empirical work that, wherever possible, generated new data. Researchers had to trawl through masses of information in multiple languages over months and sometimes years in order to create new datasets:

This focus on empirical research is grounded in the idea that analysis informed by the hard work of empirical research is the most valuable contribution we can make to the policy debate. People don’t have to agree with our analysis, but it at least provides a factual basis for a debate.

Drawn from the book on the institute’s first 20 years: An informed and independent voice: ASPI, 2001–2021.

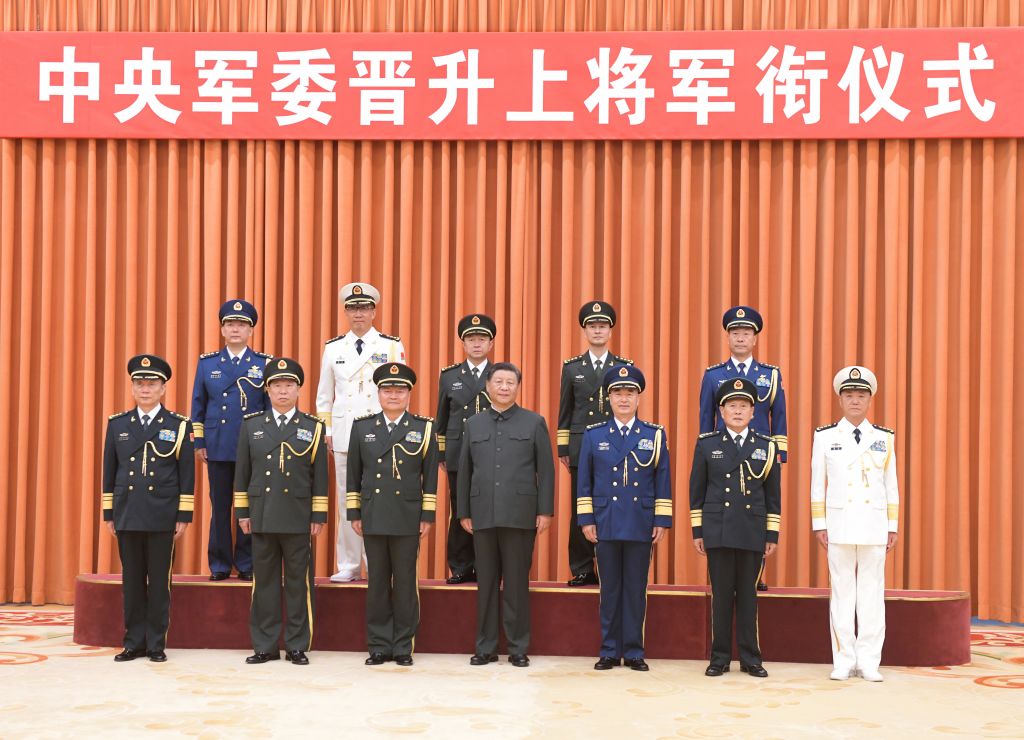

The careful selection by Chinese leader Xi Jinping of military officers for rapid promotion to key positions in the People’s Liberation Army may signal both a wish to consolidate the military behind him and a concern about emerging security challenges in China’s far western regions.

While the global focus in recent weeks has been on the US withdrawal from Afghanistan and then the announcement of the AUKUS pact, the PLA’s personnel dynamics are an important indicator of China’s geostrategic priorities and Xi’s political status that should not be ignored.

As chairman of the Central Military Commission, Xi has aimed to build what he’s called a ‘patron–client relationship’ by rapidly promoting young generals and putting them in important positions to win their loyalty, which can further strengthen his control of the military.

In July, Xi promoted four senior officers to general, the highest rank for officers in active service. It’s notable that Southern Theatre commander Wang Xiubin, Western Theatre commander Xu Qiling, Army commander Liu Zhenli and Strategic Support Force commander Ju Qiansheng are all from the army.

In September, Xi promoted five more generals, Western Theatre commander Wang Haijiang, Central Theatre commander Lin Xiangyang, PLA Navy commander Dong Jun, PLA Air Force commander Chang Dingqiu and National Defence University president Xu Xueqiang.

Despite the common view that China’s navy is the primary service being modernised, the Eastern and Southern Theatre Commands are the PLA’s strategic focus, and most of the recently promoted generals are from the army. Since 2016, when Xi began reforming the military, he has promoted 39 generals, 20 from the army, 10 from the air force, and only four from the navy.

There may be more vacancies in the army and air force because they assist other services such as the People’s Armed Police (PAP) and the Strategic Support Force (PLASSF). Most PAP generals come from the army, and PLASSF generals tend to have an air force background (see figure 1).

Figure 1: PLA promotions to general by service, 2016 to 2021

Generals from China’s western regions have been the most likely to be promoted. Since 2016, Xi has promoted 15 theatre commanders and theatre political commissars. Five generals were from the Western Command, three were from each of the Southern and Central Commands, and two were from the Eastern and Northern Commands (see figure 2).

Figure 2: PLA promotions to general by theatre command, 2016 to 2021

Six of the nine generals promoted in July and September rose from the rank of lieutenant general within two years. Seven were born after 1962, so they’ll be under 60 in 2022 after the Chinese Communist Party’s 20th national congress.

The selection of these officers is relevant to the military and regional security but also to the party.

The army still plays an important part in military modernisation due to its external strategic focus, its role in maintaining internal stability, and historical factors.

With its vast land borders, China has faced more disputes and threats on its northwestern frontier than from its southeastern maritime approaches since the imperial period.

These geostrategic and historical factors led imperial China to emphasise defending its western regions, and the PLA has had a traditional focus on land defence rather than coastal defence. Even as China has gradually expanded its maritime activities beyond the so-called first island chain, it still sees ensuring internal stability as a priority to keep the CCP in power.

Since the armed police were moved fully under the Central Military Commission’s control in 2018, there’s been deeper cooperation between the PLA and the PAP aimed at ensuring internal stability. This underscores the army’s importance in land defence during wartime and in strengthening the PAP in times of peace.

China’s Southern Theatre Command faces the possibility of disputes and conflict with regional countries in the South China Sea, but the Western Command is responsible for dealing with any possible external threat, such as from India, and internal instability in regions such as Xinjiang and Tibet.

That both Western Theatre commanders and political commissars are being selected for promotion suggests Beijing is focusing on emerging security challenges in its far western regions.

Media reporting notes that General Li Fengbiao is political commissar of the Western Command. That places a general in an important party position and strengthens the political commissar’s influence in the command.

For the CCP, ‘Political power grows out of the barrel of a gun’ (槍桿子出政權) is the iron rule left by Mao Zedong, and ‘The party commands the gun’ (黨指揮槍) has become a benchmark since then. Although Xi has successfully removed the previous power structure by cleaning up the ‘four big tigers’ with his military reforms, controlling the military is still the most important issue for him to ensure his political status in his third term.

If Xi can continue to dish out rapid promotions to generals he selects, beyond the PLA’s practice, that can help keep his political power and status relatively stable.

These developments, especially Xi’s focus on the Western Theatre Command, may mean he is placing a greater emphasis on meeting internal security threats than on any external conflict.

But Xi has pledged to resolve the Taiwan issue in his term as leader. If the instability in western China continues or escalates, he may respond to a more contested security outlook in East Asia by promoting rising nationalism to ease domestic pressure.

On the other hand, if China stabilises both relations with the West and the situation in Central Asia, Xi may be confident that he can fully focus on unifying Taiwan by 2027, which is the PLA’s 100th anniversary and the year of the 21st party congress.

Overshadowed by the excitement around AUKUS was a perhaps more significant development in strategic relations that came just the next day: China formally applied to become a member of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, or CPTPP.

Countries should always remain open to establishing collegial relations. In June 2020, Chinese Premier Li Keqiang declared that Beijing had a ‘positive and open attitude’ towards joining the CPTPP, but whether China’s application is serious or is intended as a ploy, either to show up the US or to block Taiwan’s own bid, it should be considered seriously by all CPTPP members and must not be dismissed out of hand. However, neither Taiwan’s nor any other country’s application should be delayed pending progress elsewhere.

In deciding to commence the accession process for the United Kingdom, the CPTPP Commission took note of Britain’s ‘history as a supporter of the rules-based trading system, its experience with high-standard trade and investment rules’ and its ‘affirmation of its intention to comply with the obligations of the CPTPP’.

China’s history is not supportive of the rules-based trading system and Beijing’s common practice is to disregard its previously made commitments. Despite the commitments China made when it joined the World Trade Organization, state control has spread into almost every corner of the Chinese economy and beyond.

China has also demonstrated a disregard for commitments it has made to others, including by treaty and including to CPTPP members. It would be folly to ignore the evidence of China’s approach to commitments it has made around the world. CPTPP members should not walk into the same trap twice. Instead, they should require much more than just an affirmation of intent from China before accepting reciprocal obligations.

In 2020, China launched a unilateral and politically motivated trade assault against Australia, a CPTPP member. Despite the China–Australia Free Trade Agreement, China’s government has refused any effort to resolve the dispute through direct communication with the Australian government at the ministerial level for 18 months. This strong record of disregard for resolving trade disputes must be considered in assessing the authenticity of China’s affirmations of its intention to comply with CPTPP obligations.

Similarly, China has repeatedly declared that its ratified treaty, the Sino-British Joint Declaration on Hong Kong, is irrelevant. It has utterly disregarded its commitments under the treaty and regularly threatens those who suggest that it should comply with its treaty obligations.

China also disregards its obligations under the United Nations Universal Declaration of Human Rights and similarly threatens those who suggest it should comply with those obligations.

China has demonstrated a willingness to use the limits on enforcement powers under its trade agreements to create asymmetric power relationships. For instance, in breach of ChAFTA, it used unofficial instructions to halt imports of Australian coal to punish the Australian government for seeking an inquiry into the origins of the Covid-19 pandemic.

Australia complained to the WTO over several other trade sanctions, but the process requires an extended investigation period which may only result in Australia being permitted to retaliate by imposing similar restrictions. The system is premised upon the assumption that members intend to comply and that defecting is an aberration. There is no basis for believing that assumption applies to China.

The CPTPP is largely an agreement to treat companies equally, regardless of the country they come from. Importantly, it is intended to be a ‘high quality’ agreement. So, for instance, while Article 2.4 focuses on the elimination of customs duties, China has recently demonstrated a willingness to use informal trade restrictions, such as unofficial instructions to simply not process goods coming from Australia. Such moves would certainly be against the spirit of the CPTPP.

How, then, should CPTPP members respond to China’s formal application to join the group?

CPTPP members should consider their positions very carefully and not rush their response. They should invite Chinese representatives to testify in support of the application, but they should also invite those with experience of China’s history of compliance with obligations arising from treaties and other agreements to give evidence. Consideration should be given as to how any assurances from China that it will comply with CPTPP obligations could be relied upon.

Members should be confident that any agreement with China is consistent with the spirit of the CPTPP. There is little point in an agreement that, through country-specific exemptions, fails to bring about the fair, rules-based trading regime envisioned.

Members should seek to resolve these issues by opening an extended consultation process with China and its trading partners examining how China will rebuild the trust required to commence the formal accession process. Members should feel no pressure to rush this process. The CPTPP instructs members to respond in a ‘reasonable amount of time’. In this case, a reasonable amount of time should be proportional to progress and China’s effort.

Trust should not be conferred in a single discrete moment but sustained in a continuous process. Having so thoroughly abused trust in the recent past, China needs a path back. That relies on extensive and ongoing transparency, confirmation and accountability.

Because of the depth of China’s breach of confidence, such a mechanism should not end once the formal accession process begins, or even upon China becoming a member of the CPTPP. Special provisions should apply that require heightened transparency and compliance verifications, and a more rapid and compelling mechanism to ensure that compliance.

In light of China’s hostage diplomacy, CPTPP members should be careful to ensure that there is no suggestion that its recent abusive actions can be valued as bargaining chips to trade away. Ceasing those actions cannot buy goodwill. China is already obliged not to engage in hostage diplomacy and ending such practices should be a non-negotiable pre-condition before any formal accession process can begin.

CPTPP members should insist on these extraordinary processes because China’s actions have been extraordinary. Ensuring China complies with high-quality fair-trade rules was, after all, a major part of the point of the CPTPP. Allowing China to join the CPTPP and enjoy all the benefits of membership while continuing to ignore its obligations would be a historic mistake.

When Australia announced the AUKUS pact together with the United States and United Kingdom, it knew that China would be hostile and France would be disappointed. Predicting the reaction in Southeast Asia would have been more difficult: views vary. From Australia’s perspective, its relations in the region have generally been good in recent years. So much so, that Jakarta even welcomed Canberra’s 2020 defence strategic update, though it foreshadowed Australia playing precisely the more regionally ambitious role that it is now pursuing.

While some countries, notably the Philippines and Singapore, were positive about the AUKUS announcement, statements from Jakarta and Kuala Lumpur reflected concerns that the AUKUS arrangement would contribute to a regional military build-up, raising tensions and making conflict more likely.

These perspectives don’t accord with Canberra’s strategic world view, so the temptation to dismiss them in various ways will be strong.

Most fundamentally, some will see Indonesia and Malaysia as strategically naive: China is launching new ships and submarines much faster than the US, let alone Australia. And a move like AUKUS that signals a strong US commitment to the region should help prevent China from dominating it, something every country is worried about. They’ll take comfort from the fact that the Philippines, one of the key claimant states in the South China Sea, is much more supportive, and that Vietnam is likely to be too.

Some will try to airbrush Southeast Asia out of the ‘Indo-Pacific’ entirely, pointing out that Japan and India, the two most consequential regional powers, are supportive of AUKUS.

And some will argue that the Indonesian reaction was ‘avoidable anxiety’—in other words, something that could have been prevented with better Australian diplomacy.

Others will say that private reactions, especially in the region’s defence ministries, which work closely with Australia and the US, are probably more positive than what’s being said publicly. They’ll point out that practical defence cooperation remains strong; actions speak louder than words.

Canberra must resist the solace of these approaches and take regional reactions to AUKUS seriously.

Regional views matter, because Canberra’s own defence strategic planning describes Australia’s cooperative defence activities with regional countries as ‘fundamental to our ability to shape our strategic environment’. It notes the importance of our defence forces maintaining operational access in the region, and of our being able to lead coalition operations when it is in the interests of the region that we do so.

In short, our ability to respond to plausible China-related contingencies in Southeast Asia depends on regional countries seeing that our interests align with theirs. Euan Graham’s account of the 2020 West Capella incident, involving the US, Australia and Malaysia, neatly illustrates this point. A US Navy strike group sailed close to the area where a Malaysian drillship, the West Capella, was being intimidated by a Chinese maritime force. Though the US intended a strong message of reassurance, Malaysia had mixed feelings about the intervention, fearing that the presence of any warships and vessels could increase tensions and raise the risk of conflict.

At the heart of these differing perceptions is this: Australians by and large see the US as a benign and moral actor, upholding the regional security order. By definition, its actions don’t destabilise the region. Some of our neighbours are more ambivalent, seeing both the US and China as contributing to a more tense and unstable region. These concerns were eloquently expressed by Singapore’s Prime Minister Lee Hsien Loong in his 2019 Shangri-La Dialogue address. That speech drew the ire of some Americans, who argued it was wrong to see the US and China as morally equivalent.

Taking this sense of moral equivalence seriously is not the same as agreeing with it. Australia should not resile from AUKUS or the idea that the full range of our security cooperation with the US is beneficial for the region. But because not all countries automatically agree, these benefits must be demonstrated, not merely asserted. This is why it’s so important for the US to participate in mutually beneficial regional economic arrangements, like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, and continue to provide public goods, like vaccines.

A second, related opinion across the region is that AUKUS indicates an intention by outside powers to determine the future of the region, adding to fears that ASEAN’s influence and coherence are being eroded. This perception arose not because of the substance of AUKUS—an agreement to share defence technology—but because of its form, a loudly announced Anglosphere security partnership. That cannot be undone, but it has lessons for the way Australia talks about the extensive deepening of the US defence relationship envisaged in last week’s AUSMIN statement.

We shouldn’t exaggerate the degree of negative opinion in the region about AUKUS. But if there’s any uncertainty, the prudent course of action would be to assume that concerns are real and deeply held, not to blithely hope that ultimately Southeast Asia will come around to our way of seeing the world.

Within the span of a generation, a new super-rich class emerges from a society in which millions of rural migrants toiled away in factories for a pittance. Bribery becomes the most common mode of influence in politics. Opportunists speculate recklessly in land and real estate. Financial risks simmer as local governments borrow to finance railways and other large infrastructure projects. And all of this is happening in the world’s most promising emerging market and rising global power.

No, this is not a description of contemporary China, but rather of the United States during the gilded age of roughly 1870 to 1900. This formative period of American capitalism is remembered as ‘gilded’, rather than ‘golden’, because beneath the veneer of rapid industrialisation and economic growth, many problems festered.

Public backlashes against the gilded age triggered wide-ranging economic and social reforms that ushered in the progressive era that ran approximately from the 1890s to the 1920s. This domestic revolution, along with imperial acquisitions abroad, paved the way for America’s rise as the superpower of the 20th century.

China is currently passing through a similar—though certainly not identical—phase. After coming to power in 2012 during China’s own gilded age, President Xi Jinping now presides over a country that is far wealthier than the one ruled by his predecessors. But Xi also must confront a host of problems that come with a middle-income, crony-capitalist economy, not least corruption. As he warned in his maiden speech to the Politburo in 2012, corruption ‘will inevitably doom the party and the state’.

Over the past few decades, China’s economy has soared alongside a particular type of venality: elite exchanges of power and wealth, or what I term ‘access money’. Beginning in the 2000s, the incidence of embezzlement and petty extortion fell as the government built up its monitoring capacity and enthusiastically welcomed investors. But high-stakes graft exploded as politically connected capitalists plied politicians with lavish bribes in exchange for lucrative privileges.

Along with cronyism came rising inequality. Since the 1980s, income inequality has risen faster in China than in the US. China’s Gini coefficient (a standard measure of income inequality) exceeded America’s in 2012. And Chinese wealth inequality is even wider than income inequality, because those who accumulated assets during the early growth stages realised enormous gains.

A third problem is systemic financial risks. In 2020, the finance ministry warned that local government debt was approaching 100% of all revenues combined. If local governments default, the banks and financial institutions that loaned them massive sums will be exposed, potentially setting off a chain reaction. And it is not just government finances that are in trouble. China’s second-largest property developer, Evergrande, is US$300 billion in debt and nearing insolvency.

These simmering crises should not be viewed in isolation; rather, they are interconnected parts of China’s gilded age. Corruption in the form of access money spurred government officials to promote construction and investment aggressively, regardless of whether it was sustainable. Luxury properties that enriched colluding state and business elites have mushroomed across the country, while affordable housing remains in short supply. Those with political connections and wealth have easily reaped outsize profits through speculative investment.

Likewise, in the digital economy, what was once a free-for-all arena has consolidated around a few titans that can easily crush smaller players. Factory workers are being replaced by gig workers who toil long hours with scant labour protections. Fed up with excessive materialism and the rat race in society, young people are protesting by ‘lying flat‘ (ceasing to strive).

The decadence of China’s gilded age poses multiple threats for Xi. Corruption, inequality and financial meltdowns can trigger social unrest and erode the legitimacy of the Chinese Communist Party, given its promise of equality and justice. These problems—particularly elite corruption, which enriches rival factions—all undermine Xi’s personal hold on power.

Thus, Xi is determined to take China out of its gilded age, both to save the CCP and to cement his own legacy as the leader who will deliver the party’s ‘original mission’. Whereas Deng Xiaoping aspired to make China rich, Xi says he wants to make China clean and fair as well.

In the last two months, Western investors have abruptly awoken to Xi’s calls for ‘common prosperity’. But Xi’s socialist mission actually began in 2012, when he vowed to eliminate rural poverty and simultaneously launched the largest anti-corruption drive in the CCP’s history. Xi has maintained these campaigns despite the pandemic, and he proudly proclaimed in 2020 that his poverty alleviation targets were achieved on schedule.

More recently, these campaigns have extended into a wave of regulatory crackdowns on big tech companies, bans on private tutoring, caps on house prices, and a clampdown on rich celebrities. To top it off, Xi has personally exhorted the rich to share their wealth with society.

America’s gilded age provides a historical lens for making sense of Xi’s actions. All crony-capitalist economies, no matter how fast-growing, eventually run into limits. If American history is any guide, the problems facing China today do not necessarily spell doom. Much depends on what policymakers do next. If the problems are tackled appropriately, China, too, can move from risky, unbalanced growth to higher-quality development.

But whereas the American progressive era relied on democratic measures to fight crony capitalism—for example, through political activism and a ‘muckraking’ free press that exposed corruption—Xi is attempting to summon China’s own progressive era through command and control. The world has yet to witness a government successfully overcome the side-effects of capitalism by decree.

Decades earlier, Mao Zedong tried to command rapid industrialisation and failed disastrously. The lesson is that because top-down orders can and do backfire, they must not be relied upon as the solution to all problems. If excessively and arbitrarily applied, bans and edicts will diminish investor confidence in Chinese leaders’ commitment to rules-based markets.

Progressivism in America laid the domestic foundation for the country’s international primacy in the 20th century. Whether Xi can order China out of the gilded age will determine the continuity of China’s rise in the 21st.

Could Xi Jinping be toppled by a coup d’état? In China coup, Roger Garside describes precisely such a scenario—a coup mounted by Xi’s rivals to push him into retirement prior to the November 2022 national congress of the Chinese Communist Party at which he expects to be extended for another five years as general secretary, or perhaps even anointed as chairman for life.

Garside has had an illustrious career in the financial sector and as a diplomat, including two stints at the British embassy in Beijing. In China coup he applies his extensive experience to map out a plausible scenario for Xi’s ouster.

The coup is led by Xi’s rivals in the top leadership, Premier Li Keqiang and Politburo Standing Committee member Wang Yang, respectively the second- and fourth-ranking members of the CCP. They are supported by Vice President Wang Qishan and several top generals. The coup leaders strongly rebuke Xi for his misguided policies, force him to take immediate retirement and nominate Li to replace him. Significantly, they also initiate political reforms to put China on the path to democratisation.

China seeks to portray itself as a political monolith whose leadership enjoys unquestioning support. In reality, its political divisions run deep. To put Garside’s coup scenario in context, one needs to go back to the 2007 party congress, which decided who would take over from party secretary Hu Jintao in 2012. At the start of the congress, Li Keqiang, a reform-minded member of the Communist Youth League faction, was the frontrunner, strongly supported by Hu. The number two slot of premier was intended for Xi. Following much infighting, however, Li lost out to Xi, who at the time was backed by Hu’s predecessor Jiang Zemin.

Once Xi rose to power in 2012, he reduced the membership of China’s key decision-making body, the Politburo Standing Committee, from nine to seven and loaded it with his own supporters. As a result, Li and Wang Yang are the only committee members who belong to the reformist ‘opposition’. During his nine years in power, Xi has made every effort to marginalise Li, even stripping him of the finance portfolio traditionally held by the premier. He has also limited the role of ‘opposition’ institutions, in particular Hu’s and Li’s power base, the Communist Youth League.

Xi’s subsequent moves to bolster his own position and build a personality cult have aggravated party elders and regular Chinese alike. A recent essay by retired premier Wen Jiabao that was seen as indirectly critical of Xi faced widespread viewing restrictions, while the recent introduction of ‘Xi Jinping thought’ in the school curriculum has caused consternation among Chinese parents.

Xi’s campaign to weed out corruption—and political opponents—has gained him many enemies, as have moves to reshape China’s business, political and cultural landscape. China’s regulators have recently imposed strict conditions on large companies in the tech, online education and video gaming sectors, in the process wiping out a significant portion of their market value. New restrictions on ‘socially harmful behaviour’ have also proved unpopular.

The events in the first and last chapters of Garside’s book are fictitious, although the characters are real. The rest of the book discusses China’s myriad problems and Xi’s shortcomings. Significantly, Garside notes that Xi has moved China from authoritarianism to the brink of outright totalitarianism.

The coup described in the book is triggered by the threat of a financial war with the United States that would play havoc with China’s economy. But Xi’s ouster is intended to address a long list of grievances, bring about leadership change and usher in political reform.

Garside draws two important historical parallels. First, he reminds us of the disaster wrought on China by Mao Zedong through the 1958–1962 Great Leap Forward and 1966–1976 Cultural Revolution, suggesting that Xi’s increasingly hard-line state-driven policies could take China towards another disaster.

Second, Garside reminds us of the power struggle surrounding Mao’s death, and its relevance to the present day. When Zhou Enlai died in early 1976, eight months before Mao, widespread demonstrations in support of the popular premier were suppressed. The heir apparent, Deng Xiaoping, was then ousted, followed, after Mao’s death, by the arrest of the widely disliked Gang of Four, the short-lived reign of Mao’s chosen successor Hua Guofeng, and Deng’s comeback.

By further centralising power with himself, and without a clear heir, Xi could be setting China up for a repeat of Mao’s chaotic succession.

It is widely assumed that next year’s party congress will either extend Xi for a third five-year term as general secretary or, better still from Xi’s point of view, elevate him to his desired position as party chairman. The title has not been used since the days of Mao and is closely associated with his dictatorship.

Garside’s book serves as a timely reminder that there are deep divisions within the CCP, that many of Xi’s policies are vastly unpopular, and that he has powerful enemies among the party’s top leaders. Most importantly, Garside reminds us that the outcome of the 2022 party congress is not a done deal.

On 5 September, Guinea’s special forces took control of the country, detaining the president, Alpha Conde, and suspending the constitution. Citing endemic corruption, human rights abuses and poverty, coup leader Lieutenant Colonel Mamady Doumbouya announced the next day that a new administration of ‘national union’ would be formed in the coming weeks.

During a scheduled press conference that day, a Chinese foreign ministry spokesperson said that Beijing was closely following developments and that it opposed the military unit’s actions and called for the president’s ‘immediate release’. What’s striking is Beijing’s break with its posture of ‘non-interference’, issuing such strong statements on a country’s domestic politics. In Guinea’s particular case, however, there are good reasons for China to pay close attention to political developments there.

The first is the extent to which Guinea’s coup impacts China’s long-term strategy to diversify its iron ore suppliers. Part of that strategy has involved turning to Africa. With two of Beijing’s top 15 suppliers—South Africa and Mauritania—already in Africa, Chinese companies are currently studying reserves in Algeria, Cameroon, Republic of Congo, Liberia, Senegal, Sierra Leone, Gabon, Nigeria and Madagascar.

However, Guinea is unique. A mineral-rich country, its 100-kilometre-long Simandou mountain range holds an estimated 8.6 billion tonnes of iron ore graded at more than 65.5%, seen to be one of the world’s last untapped high-grade reserves. The Guinean government had leveraged Simandou’s potential for Chinese investment in a major 650-kilometre railway project, a deep-water port and related facilities as part of China’s Belt and Road Initiative.

Thus far, Beijing has been reluctant to bring Australian iron ore imports into its campaign of economic coercion against Australia, in which the beef, barley, lobsters and wine industries have been badly hit. While some analysts say Guinea represents ‘one of the best medium- to long-term solutions to reduce dependency’ on Australian iron ore and others caution it’s not big enough to free China from its reliance on Australian supply, Guinea’s reserves carry the potential to give Beijing some leverage.

Guinea’s potential still depends on a few factors. For one, it’s not clear that the coup leaders and interim administration will honour agreements signed with Chinese companies under the previous government. One such agreement, signed between the Conde administration and the SMB-Winning consortium in June last year, allows the Chinese–Singaporean–Guinean group to acquire the mining rights to two blocks in the north of Simandou worth roughly $19 billion.

Plans to develop Simandou have stalled over the past two decades due to corruption and fluctuating levels of interest, despite the involvement of a number of mining companies and investors (Rio Tinto was the first foreign investor given a licence to explore in 1997). If China is prepared to double down on Simandou, it will have to pay up to $20 billion over the next five years to develop the infrastructure and mine. As one analyst noted, ‘in these tenuous times China appears ready to make that investment’.

Domestic factors in China like cuts to steel production, restrictions on pollution and the precarious financial situation of large property developers will also shape Chinese purchases of Australian iron ore. The coup adds greater uncertainty for now to Beijing’s plans.

In addition to iron ore, China is also worrying about disruption to its supply of aluminium. As the world’s second largest supplier of bauxite, Guinea meets 55% of China’s demand for it. With fears that the political turmoil could disrupt supply, the price of aluminium hit a 10-year high on the day after the coup. For now, mining companies are exempt from Guinea’s nationwide curfew; however, the status of operations on the ground remains unclear. Some operators said it was business as usual, while other companies did not confirm. If that situation changes, Canberra and Jakarta could benefit. Together with Guinea, Australia and Indonesia comprise 99% of China’s bauxite purchases.

With those key commodities in mind, there are legitimate concerns in China about Guinea’s future economic and political stability. While there has so far been no resistance from other army units, including the presidential guard, risks remain. A Chinese official with the economic and commercial office of the Chinese embassy in Guinea warned of several factors including a general economic slowdown. While Conde’s removal has been celebrated by some Guineans, if coup leaders are unable to satisfy both his supporters and opposition camps, the risk of public unrest remains. Violence erupted and 21 people were killed after last year’s presidential election in October. Shops were closed, and internet and telephone networks severely disrupted or shut down for a few days.

China has called for the president’s release, but that would do little to address the waning public confidence in Guinea’s political system. The country’s democracy was already under siege before the coup. Last year’s legislative election and constitutional referendum were postponed for two weeks after the Organisation internationale de la Francophonie, an organisation of French-speaking governments, raised concerns about 2.49 million ‘problematic’ entries on the electoral roll.

But Guinean public support for the ousting of the president should not be thought of as support for military rule. Memories of brutal periods of military intervention run deep. In September 2009, soldiers killed 157 unarmed coup protesters in a stadium, leaving 1,253 wounded, with 109 women raped or sexually abused.

Chinese state media network CGTN aired the statement of a Guinean government spokesperson who was ‘worried’ about bilateral ties with China, calling on ‘everybody to work together to save this cooperation’, particularly on current and future projects. And yet, despite its massive and concerted investment in infrastructure, emerging markets and even peacekeeping across the African continent, it seems there are few levers Beijing can pull in order to substantially influence political and military actors on the ground. Despite being ‘all in’ on Conde as a means of guaranteeing access to commodities, Beijing will have to invest anew in keeping Guinea’s new powerbrokers on side.

In a recent Lowy Institute paper, the Center for New American Security’s Thomas Shugart warns that China is building up its military capacity to coerce Australia directly, particularly in the event of US strategic retrenchment from the Indo-Pacific region.

He suggests a scenario in which China is successful in taking Taiwan; Japan and South Korea, sensing the waning of US power, then choose to be ‘Finlandised’ under Beijing. With the US ejected from East Asia, China can then wield an implied threat or actual use of force to coerce others, including Australia, to accept Chinese hegemony.

This scenario is open to challenge. It seems unlikely that Japan would quickly accommodate an aggressive China and nor is South Korea likely to accept becoming a mere tributary state. It’s more likely that key US allies in the Indo-Pacific, including Australia, would work to strengthen their defence and security relationships with Washington through greater burden-sharing, including through multilateral groups such as the Quad. It’s not in the US’s interests—or those of its allies—to cede a large strategic space to a rising China, because, as Shugart notes, further demands will soon follow.

Shugart’s analysis is solid on the military challenges that China presents to Australia, especially in the event that the US isn’t able or willing to maintain a forward presence in the region. He correctly observes that the People’s Liberation Army’s conventional missile capabilities, particularly the PLA Rocket Force’s DF-26 and emerging air-launched systems including air-launched ballistic missiles (ALBMs), can target key military facilities across Australia’s north and northwest. The PLA’s naval capabilities and the growth in China’s maritime militia and coastguard, Shugart notes, are increasing the risk that Beijing could apply indirect military pressure on Australia by blockading key sea lines of communication if the US withdraws from the Indo-Pacific over the next two decades.

Australian defence planners need to start thinking about these two military challenges more seriously. Considering the missile threat first, our key defence facilities across the north and northwest are largely undefended and vulnerable to long-range Chinese missile systems. As Shugart argues, if China were to deploy the DF-26 onto Hainan island, it could reach Western Australia’s North West Cape, the Darwin and Tindal regions in the Northern Territory, and Royal Australian Air Force Base Scherger in Queensland. The PLA Air Force’s H-6N bomber, carrying the CH-AS-X-13 ALBM, could extend that threat envelope south to cover other major Australian defence facilities including Woomera in South Australia, Fleet Base West near Perth, and HMAS Cairns and RAAF Base Townsville in Queensland. Add in future growth of China’s naval capabilities, including more advanced submarines equipped with land-attack cruise missiles, and the missile threat to Australia looks set to become more acute.

Defence projects AIR 6500 Phase 2 and LAND 19 Phase 7B are considering medium-range missile capabilities suited for defending expeditionary joint forces rather than a continent. There are currently no plans for a dedicated ballistic missile defence capability against longer range, higher speed threats such as the DF-26 or ALBMs.

There are risks in considering more expansive ballistic missile defence, given its patchy success in carefully managed tests and the huge costs associated with developing such a capability. Creating a true national missile defence network is likely beyond Australia’s ability. But a more focused defence of critical facilities in our north and west against long-range threats is worth considering. That might involve building a network of land- and sea-based interceptor missiles, exploring the option of acquiring Aegis Ashore, and extending our anti-access and area-denial capability using forward-deployed interceptors. Those capabilities would need to be matched by enhancements now underway to the Jindalee over-the-horizon radar network, and that in turn could be complemented by a space-based multinational missile early warning system to boost defences against hypersonic weapons.

The goal would be a more potent, longer range defence of critical military facilities in our north and northwest, as well as essential facilities such as Pine Gap and Fleet Base West. Such a system should be developed in partnership with the US and Japan and be designed for growth in numbers of interceptors and integration of new technologies.

At the same time, it makes sense to harden our northern military facilities and start thinking about how we might employ dispersed military forces more effectively to complicate an adversary’s planning. In spite of the fact that $1.6 billion is being invested to upgrade RAAF Base Tindal, the infrastructure there won’t include any true hardened aircraft shelters. Planners also might want to think about how to better defend Jindalee’s sensors from missile strikes.

Shugart’s suggestion that China might use a naval blockade ironically represents a far larger problem for Australia because Beijing could interdict critical maritime commerce at much greater distances from our shores, well within its anti-access and area-denial envelope. China could bring the full weight of its maritime forces to bear against Australian commercial shipping—though most of the vessels would be foreign-flagged—quickly cutting off vital supply chains including essential fuel supplies. The most effective way to achieve this would be to seek to control chokepoints in maritime Southeast Asia from forward bases in the region, using a combination of grey-hulled PLA Navy and white-hulled China Coast Guard vessels.

Australia would find such a blockade virtually impossible to break given the small size of its navy. While boosting the size of the navy would be a welcome move, our fleet could never match China’s ship for ship. The solution to counter any Chinese intimidation lies in part with building better multilateral maritime and defence cooperation with key partners in the region, notably, Japan, India and the countries of Southeast Asia. At the same time, Australia should reduce its dependency on overseas supply chains, including for fuel and energy.

Underpinning all these steps must be moves to strengthen ties with the US and reinforce Washington’s commitment to the Indo-Pacific region. As long as the US remains an Indo-Pacific power, China’s power to coerce will be constrained.

There’s been a strong focus on the upcoming AUSMIN talks between Australia’s defence and foreign ministers and their US counterparts and calls for Australia to press the US robustly to deliver more substantive Indo-Pacific and defence exports policies.

That has to some extent overshadowed important meetings with Indonesia, India and South Korea that are about to take place and which approach the same issues from a different direction.

Next week’s meeting of Australian and South Korean foreign and defence ministers, the fifth in a series, provides an opportunity to lend more content to the process. That’s made easier because both are capable US allies, both belong to the Indo-Pacific and are substantial trade partners, and both face some similar geostrategic challenges. In the wake of the poorly planned and executed US departure from Afghanistan, calls among NATO partners in Europe, and allies in Asia and Australia, for greater self-reliance and regional coalition-building have grown. The Australia–Korea 2+2 meeting is an opportunity to give this some substance.

When a less capable South Korea faced the continuing North Korean threat, it couldn’t have been expected to focus much beyond the peninsula. But that has changed, and South Korea today has the capability, if not always the intent, to undertake wider missions supporting stability in the Indo-Pacific and elsewhere. It’s become a significant participant in UN peacekeeping and US-led counter-piracy operations in the northern Indian Ocean.

But as a RAND Corporation study argued in 2019, ‘South Korea’s defence cooperation is often seen as more piecemeal than as part of a consistent strategic approach to foreign policy aimed at binding the Indo-Pacific together; expanding the ROK’s [Republic of Korea’s] influence; and reinforcing shared norms, values and intents.’

There are two parts to this problem. Each new Korean administration seems to find it politically necessary to ditch foreign policy initiatives of its predecessor and to embark on new ones. Hence, in 2017 the Moon Jae-In administration’s ‘New Southern Policy’ replaced its predecessor’s ‘Northeast Asia Peace and Cooperation Initiative’. A consistent strategic approach is a casualty of Seoul’s sharply divided left–right politics, lessening its influence and, in the case of the NSP, is more about trade competition and diversification than about Korea pulling its strategic weight with its like-minded partners.

The other part is the imperative Korea feels to be seen to ‘balance’ between China, its biggest trade partner and near neighbour, and its longstanding ally the United States.

Like Australia, Korea has felt the harsh impact of Chinese economic coercion, with far-reaching measures imposed following its 2016 agreement to host a US THAAD anti-missile battery. And Seoul, correctly, considers Beijing to be critical in managing the ever-present North Korean threat.

But Korea’s balancing act can minimise the importance of its other regional interests, including the critical sea lines of communication through the South China Sea, along which much of the country’s highly trade-dependent imports and exports flow.

Its inability to heal historical rifts with Japan also inhibits the development of cooperation with Japan, the US and others which might serve to better monitor and balance China’s assertive policies in North and Southeast Asia.

More of South Korea’s friends are stepping up in East Asia to respond to the challenge of China. Australia, France, Germany, the Netherlands and the UK have all recently sent naval units to the region.

Pressure is mounting on Korea, not least from the US, to play a more supportive role in ensuring a free and open Indo-Pacific. Moon’s reluctant preparedness to associate with the non-military elements of the Quad responded to this pressure. Korea’s ambassador to Australia recently acknowledged that the Quad is an ‘important anchor for stability’, but Korea remains wary of military arrangements with others that could provoke further Chinese anger.

All four previous Australia–Korea 2+2 meetings have been marked by lengthy joint statements of shared views on a wide range of contemporary issues and wordy, generalised commitments ‘to strengthen cooperation to address current and evolving security in an increasingly uncertain strategic environment’, to ’work to address challenges’ and to ‘continue identifying opportunities for further collaboration in areas of mutual interest’.

Strategic dialogues and service-to-service talks seem at times to be a substitute for real work on interoperability and common purpose. It’s difficult to discern from the biennial blizzard of diplomatic speak whether much progress has in fact materialised from these earnest declarations over the past eight years.

A memorandum of understanding on defence research, development, testing and evaluation was signed in 2019, with potential work on maritime robotics identified. Korea participated, at a very modest level, in Australia’s Exercise Talisman Sabre this year. Both are certainly small steps forward. The biennial naval anti-submarine warfare exercise Haedoli Wallaby continues to be the centrepiece of bilateral defence exercising. But there hasn’t been much interest on either side in expanding the scope or frequency of exercises or service-to service collaboration outside of the separate UN Command annual exercises.

Meanwhile, Australia has committed to purchasing 30 Korean self-propelled howitzers, and Korea’s Hanwha is one of two companies bidding for Australia’s next generation of armoured personnel carriers. But as the RAND study noted, Korea’s defence exports are not coordinated or promoted as part of a broader strategic policy. A serious promotional effort might include proposals to lift the level of ambition in the defence relationship.

As in Australia, Korean public opinion has turned decisively against China, running well ahead of government policy. A conservative administration in Korea after next year’s presidential election could be more receptive to expanded defence relationships, even if formal accession to the Quad may still be considered a step too far and likely to further provoke China.

Australia has yet to take South Korea more seriously as an important element in our declared intention to build our regional defence relationships. The rapidity of strategic change both countries face in the region suggests now might be the time for them to seed substance into the 2+2. Another year of pious declarations of ‘identifying opportunities’ or ‘seeking to enhance training and exercises’ without real content devalues the currency and raises questions about commitment on both sides.

The defiant words of that old rabble-rouser Thomas Paine provide a fitting rallying cry for Western leaders after the US-led retreat from Afghanistan and the return to power of the Taliban.

The West now faces a witches’ brew of complex and daunting strategic problems crowding in on it, magnifying and deepening Western anxieties. So leaders might take comfort from Paine’s famous ‘Common sense’ pamphlet addressed to the continental army fighting for American independence in 1776.

‘These are the times that try men’s souls,’ Paine wrote. ‘The summer soldier and the sunshine patriot will, in this crisis, shrink from the service of their country; but he that stands by it now deserves the love and thanks of men and women. Tyranny, like hell, is not easily conquered, yet we have this consolation with us, that the harder the conflict, the more glorious the triumph’.

Certainly US President Joe Biden, UK Prime Minister Boris Johnson, Australian PM Scott Morrison and those of their ilk have faced times that have tried their strategic souls. They have faced a devastating pandemic and accelerating climate change while fighting the Taliban in vain for the future of Afghanistan. At the same time, violent Islamist terrorism has been an ongoing, often bloody, threat.

And throughout it all the United States, leader of the liberal democratic West, has been increasingly mired in deep political divisions that brought the country close to violent insurrection and political gridlock in the dying hours of the appalling Donald Trump presidency.

At the same time, China’s coercive military, political, diplomatic and economic policies have complicated the democratic will. While resisting China’s efforts to dislodge US-led power in the Indo-Pacific region, Western leaders and their Asian allies have struggled to manage other challenges clearly beyond the capabilities of summer soldiers and sunshine patriots.

For Australia, and others, threats posed by Chinese aggression and by America’s domestic difficulties are the gravest of these challenges. But the cumulative effect of the challenges, and their tendency to act on each other with unexpected consequences, makes the current global environment especially perturbing. A question arises: how many such crises can modern nations, with all of their political, diplomatic, economic and military resources, handle simultaneously before a fatal miscalculation occurs?

Among other things, largely futile international efforts to trace the origins of the Covid-19 virus from Wuhan in China have increased tensions between Beijing and Western powers. Now the US retreat from Afghanistan, and US dysfunctional domestic politics, have inevitably raised doubts about the future value of Australia’s alliance with the US. The international push to cut carbon emissions has intensified the effects of China’s economic bullying of Australia, notably its trade sanctions against Australian coal exports.

At the same time, a surge in Islamist terror attacks worldwide is being widely predicted following the US retreat from Afghanistan. Whatever the incoming Taliban regime says about ruling peacefully, it is a vicious movement with a record of shameless oppression and violence;. The Taliban respects no human rights and will do nothing to oppose Islamist terror that is not directed at themselves.

Tyranny, as Paine said, is not easily conquered. So how might democracies and their allies most effectively resist and contain the threat from bullies and extremists now strutting the global stage? In fact, the democracies are well placed to push back if they can muster the will to expand embryonic institutions that are already in place and (most importantly) if they can gain the active engagement of the US after the Afghanistan debacle and Trump’s dangerous post-election lies.

Buoyed by its rising power, China rejected the authority of liberal international forums when it dismissed the 2016 ruling by the Hague-based Permanent Court of Arbitration that Beijing’s claims to most of the South China Sea lacked any basis in international law.

Since then, there has been an international tendency especially by timid Indo-Pacific states to appease China by maintaining silence about the 2016 judgement. The alternative (provided that the US and its allies and friends are prepared to be more than sunshine patriots) is to balance China’s power by creating an alliance so formidable that Beijing will realise that its interests will be better served by moderating its attacks on the rules-based global order, the liberal trading system and freedom of navigation through the Indo-Pacific region.

Such an alliance, happily, exists already in embryo. The Quadrilateral Security Dialogue between the US, Japan, Australia and India is an initiative created to balance Chinese aggression, but it needs to be larger, stronger and more focused. First proposed in 2007 by Japan’s prime minister, Shinzo Abe, the Quad has conducted joint military exercises and held meetings with New Zealand, South Korea and Vietnam. Its creation and doubtless its potential military strength prompted China to declare that it ‘openly incites discord’.

Yet enlargement of the Quad is an entirely reasonable response to China’s predatory and threatening attitude towards powers including the US, Australia, Canada, New Zealand, the Philippines, Malaysia, Taiwan and Vietnam. The time for appeasement and ambivalence is past. The complex global environment—including the evolving China–Russia axis—now requires an expanded Quad to balance the activities of authoritarian powers.

Perhaps significantly, the Quad has already cautiously started to consider wider challenges by pledging this year to respond to the Covid-19 pandemic. It also has obvious interests in building cooperation on addressing global warming, terrorism and other issues haunting the international order.

Forging an expanded Quad will be difficult given China’s predictable coercive responses. But in Paine’s words, this is no time for liberal powers to shrink from service to country and (he might add) to human rights. Nor may Western powers seek the love and triumph evoked in ‘Common sense’, but the loss of Afghanistan magnifies the need for a free and open Indo-Pacific and a rules-based maritime order in a chaotic world.

International security relations have always been anarchic terrain. There is no Leviathan to keep order, but now, post-Afghanistan, an expanded Quad could help modify, perhaps ameliorate, the multiple threats that are trying people’s souls in a troubled world.